Millennials are showing such a strong desire to get into homeownership that many are willing to make big sacrifices or take on a second job.

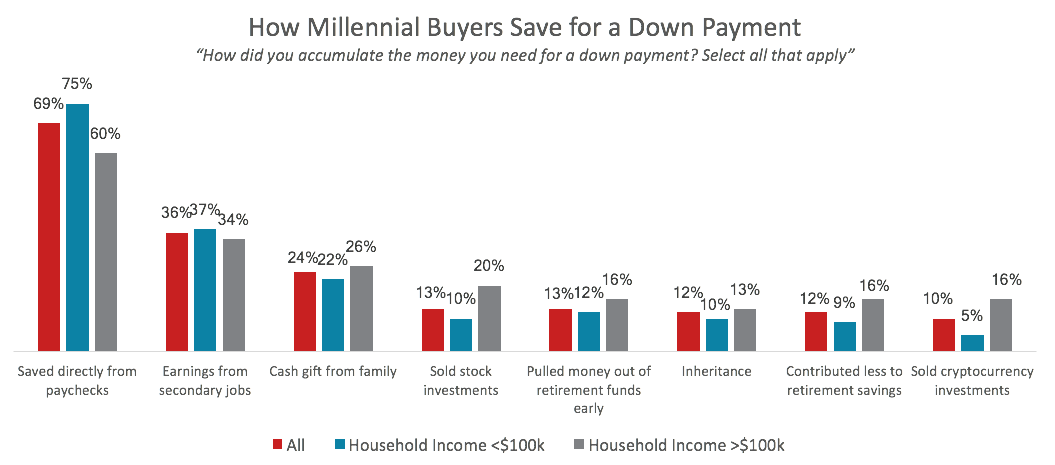

A new survey by Redfin shows that 36 percent of 500 millennial homeowner respondents aged 24 to 38 have taken a second job to save up for a down payment.

That’s because the main concern for these first-time buyers is being able to afford the down payment, cited by 50 percent of all respondents Redfin found. Other problems in the way of millennials include being able to find an affordable home in their chosen location, and rising home prices, cited by 45 percent and 41 percent respectively.

Interestingly, millennials are doing more than just taking a second job to find the cash they need. Some 13 percent say they’ve taken early distributions from retirement funds, while 12 percent have used inheritance money.

One curious statistic is that around 10 percent of millennials say they’ve sold cryptocurrency they originally purchased at a much lower price in order to afford a down payment. The study found that millennial households earning more than $100,000 per annum were three times more likely to have sold some cryptocurrency than those earning less, suggesting its the richer and better educated who are taking advantage of this trend.

“For millennials who have launched their careers while working to pay off student loans in the last decade, having enough to set aside toward a down payment would have been a significant accomplishment,” Redfin Senior Economist Sheharyar Bokhari said in a statement. “These results reveal some of the inequalities that have been exacerbated in the years following the recession, with the well-off having more flexibility and, thereby, ability to become homeowners and build more wealth through advantages like financial support from family and the opportunity to invest in the stock market.”

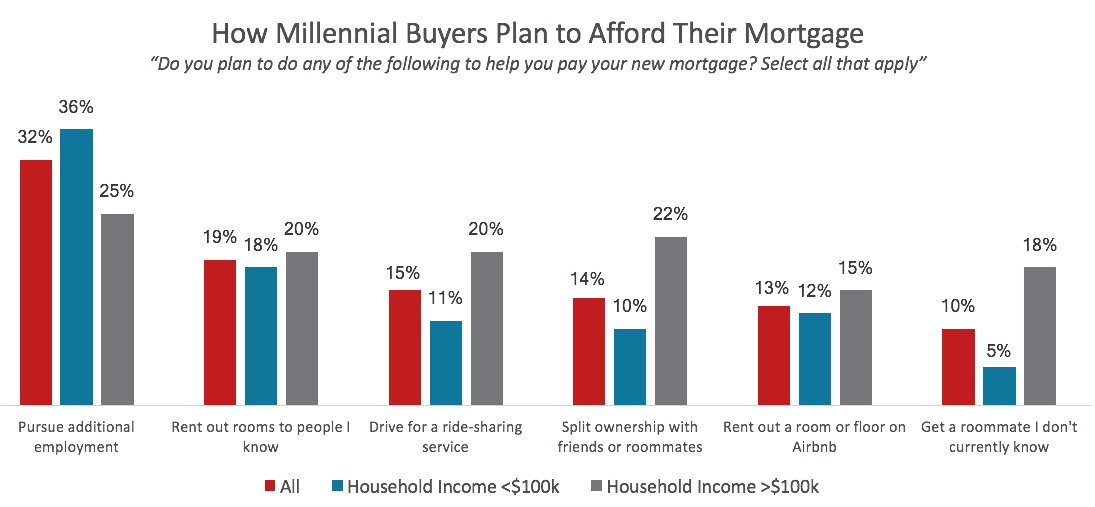

The survey found that the most popular ways for millennials to raise money for a home included finding additional employment (32 percent), renting out a room to someone they know (19 percent), driving for a ride-sharing service (15 percent) and splitting ownership of a home with friends or roommates (14 percent).

Redfin's full study is available to read here.

How about buying a Duplex or Triplex, the expected rent adds on to your income (when applying to qualify) and you have someone paying 40% of your mortgage for the next 30 years.

Why would you take an early distribution of your retirement money? Just use a retirement account that enables alternative investments and let your retirement dollars work for you with real estate investment.