A significant number of millennials report feeling trapped as renters, saying they’re unable to save enough money to become homeowners, according to a new study from Apartment List.

In its 2019 Millennials & Homeownership Report, which analyzes attitudes, expectations and actions of 10,000 millennial renters in the U.S., Apartment List notes that the vast majority would like to own a home, and see it as a “financially superior” option renting. But almost half of millennials surveyed say they have no savings for a down payment, and while some may receive financial support from their parents, the level of this support has been declining.

One of the major challenges for millennials is student loan debt. Those who are debt-free tend to save around $100 more per month that those who’re still paying off their loans.

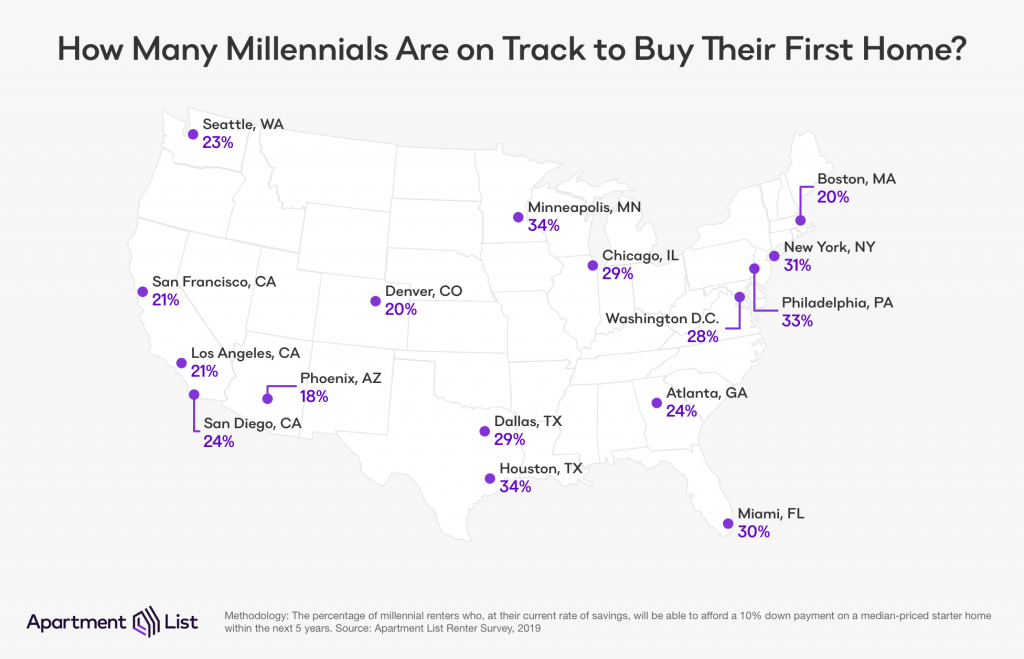

At the current savings rate, just 25% of millennials who’re currently renting will be able to stump up a 10% down payment on a median priced home in the next five years, the study found.

“If student loan obligations were dismissed, this would improve to 38 percent nationally, and more than 50 percent in some metropolitan areas like Minneapolis and Houston,” the study notes.

Even worse, just 13% of millennial renters believe they’ll be able to afford the standard 20% down payment in five year’s time.