American homeowners with mortgages gained a combined $2.9 trillion in equity during the second quarter, up 29.3% from the same period one year ago. That amounts to an average equity gain of $51,500 per borrower over the last year, according to a report from CoreLogic this week.

In its report, CoreLogic determines the amount of equity for a property by comparting its estimated value against the mortgage debt outstanding. If the MDO is less than the estimated value of the home, then it’s determined to be in a positive equity position. Should the MDO be greater, the homeowner is deemed to be in negative equity. CoreLogic formulates its report using public record data for mortgage homes together with their estimated value.

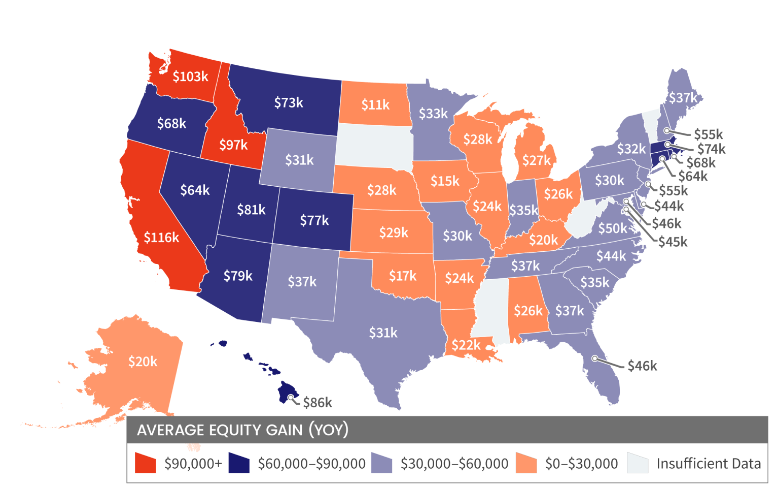

According to the report, California, Washington, Hawaii, Idaho, Utah and Arizona saw the greatest year-over-year equity gains. Indeed, Californians saw the greatest gains ever recorded, with an average of $116,000 per borrower. The Chicago- Naperville-Arlington Heights metro area had the largest share of negative equity at 5.2%.

CoreLogic Chief Economist Dr. Frank Nothaft said home equity wealth has reached a record level and that it should have some positive impacts on economic activity over the coming year.

“Higher wealth spurs additional consumer expenditures and also supports room additions and other investments in homes, adding to overall economic activity,” he explained.

There was good news for those mortgaged homes in negative equity too, as the total number fell by 12% the previous quarter to just 1.2 million homes across the U.S. In total, 163,000 homeowners in the country regained equity in the last three months. In a year-over-year comparison, 30% fewer homes were in negative equity compared to the second quarter of 2020.

Meanwhile the national aggregate value of negative equity fell by $18.9 billion, or 6.6%, compared to one year ago.

CoreLogic attributed the strong equity increase to rising consumer confidence, which hit its highest level since the start of the COVID-19 pandemic in June. A survey of mortgage holders that month found that 59% feel “extremely confident” in their ability to stay current on their mortgage repayments over the coming years. Also, the majority of borrowers who did fall behind on their mortgage payments during the pandemic have a large equity cushion, which can help them to avoid foreclosure.

CoreLogic President and Chief Executive Frank Martell said tens of millions of Americans are now enjoying this strong financial cushion, which will play a critical role in helping those struggling to keep up with their mortgage repayments avoid foreclosure.

“Based on projected increases in economic activity and home values over the next year, we expect to see further gains in equity and a corresponding drop in negative equity, forbearance rates and foreclosure,” he added.

Looking ahead, CoreLogic said that if home prices rise by another 5% in the next three months, another 160,000 homeowners would regain equity. However, if home prices fall b 5%, close to 211,000 homeowners would find themselves back underwater, it said.