A survey of more than 2,000 consumers published by Bankrate.com this week reveals that 79 percent of Americans still believe owning a home is a vital part of achieving the “American Dream”.

In fact, most Americans place homeownership ahead of other important life milestones, such as retirement (68 percent), enjoying a successful career (63 percent), and owning a car (58 percent).

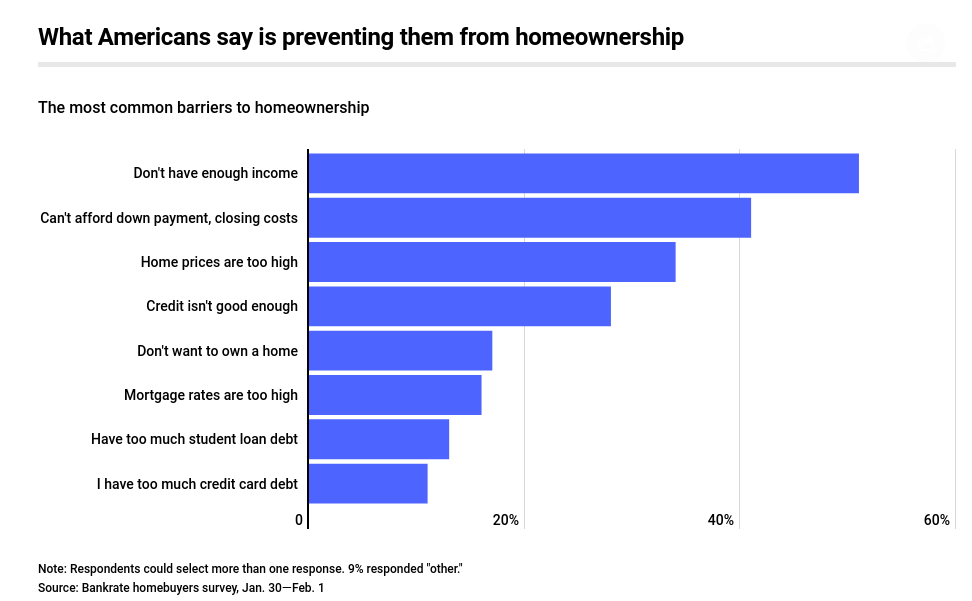

But while homeownership rated extremely highly, most survey respondents noted significant challenges in achieving it. For example, 50 percent of respondents said they don’t actually own a home because it’s unaffordable on their incomes. Some 40 percent said they couldn’t afford a down payment and closing costs, while a third said high prices were a major obstacle.

But Dana Scanlon, a real estate pro with Keller Williams Capital Properties in Bethesda, Md, told Bankrate that more people could get into homeownership if they adopt a rigid savings plan.

“Put yourself on financial lockdown for at least six months before purchasing a home,” Scanlon said. “Don’t buy new furniture, keep your old car running, and check your spending habits.”

Luis Rosa, a financial planner in Henderson, Nev., suggests a two-year plan to save up for closing costs and a down payment and to boost credit scores.