Many consumers have misconceptions about what it takes to secure a mortgage, so much so that some won’t even try to apply for one as they believe they won’t qualify.

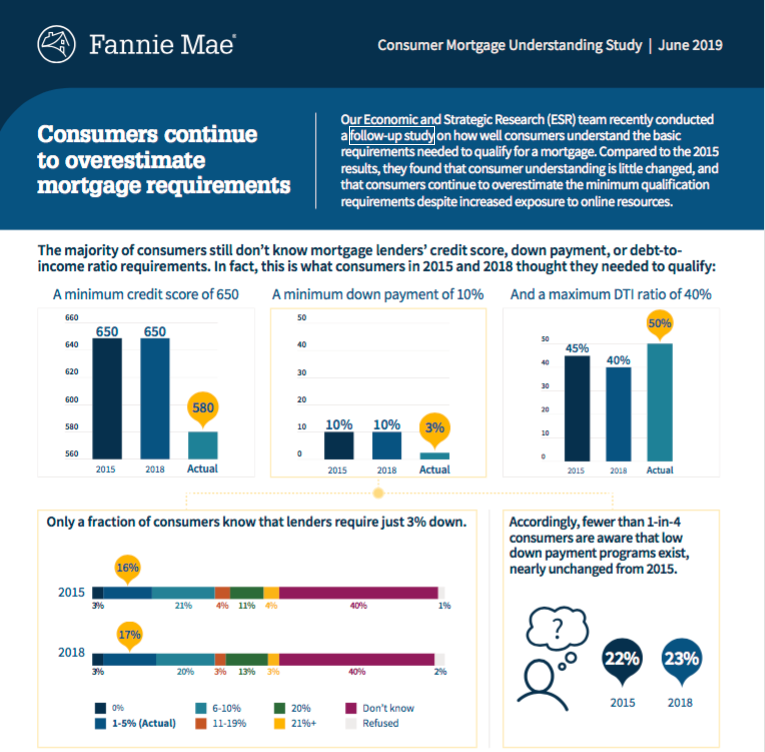

Consumers often overestimate the minimum credit score and down payment that’s required to obtain a mortgage, even though such information is readily available online. They’re also unfamiliar with low down payment programs that could help them to secure a mortgage, Fannie Mae found in a recent survey of 3,000 consumers.

In addition, almost half of consumers say their unaware of their own credit scores.

The lack of knowledge of the requirements for a mortgage is pervasive, even among current homeowners, the study notes.

“Current sources of mortgage education and information are insufficient,” write Mark Palim, Fannie Mae’s vice president and deputy chief economist, and Sarah Shahdad, a market insights researcher at Fannie Mae. “Even those actively planning to become homeowners in the next few years (i.e., those who should be exposed to more information) are only slightly more confident or knowledgeable than others.”

Fannie Mae says mortgage and real estate professionals should do more to make consumers aware of the requirements and the process for applying for a mortgage. It says “customized information” on what people can afford, how much they need to save, and the type of mortgage they should apply for, can improve outcomes.

Fannie Mae conducted a similar survey in 2015, and the results have not improved much about Americans’ knowledge about the mortgage process.

“For some Americans who would like to own a home, they could qualify for a mortgage but may assume homeownership is not a possibility,” they note. “As a result, they may avoid further research or preparations, such as saving for a down payment or improving their credit.”