Mortgage lenders are increasingly moving towards so-called digital mortgage in which many providers attempt to complete the majority, if not the entire, application process online.

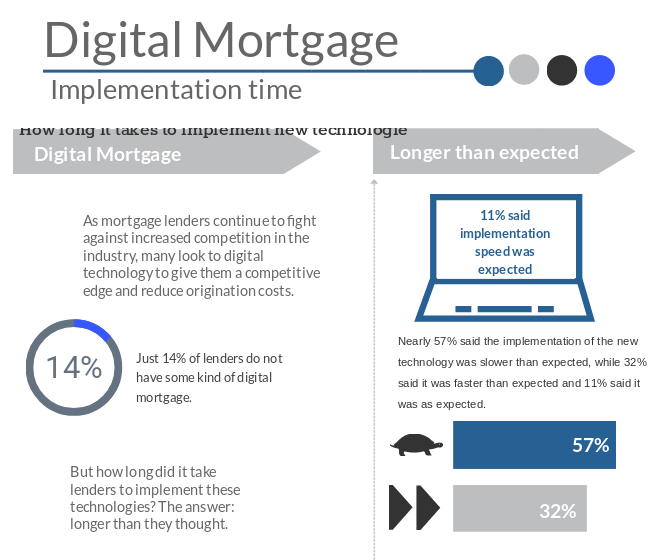

However, most lenders are struggling to implement the technology needed to provide digital mortgages in the time frames they’d hoped for. A recent survey by HousingWire and Maxwell shows that 57 percent of lenders indicate it’s taking longer than expected to implement the technologies they need. Some 32 percent said the process was faster than expected, while 11 percent said it proceeded more or less as planned.

The survey also revealed that 14 percent of mortgage lenders do not currently have a digital mortgage offering, and 36 percent do not offer a borrower’s portal of any kind.

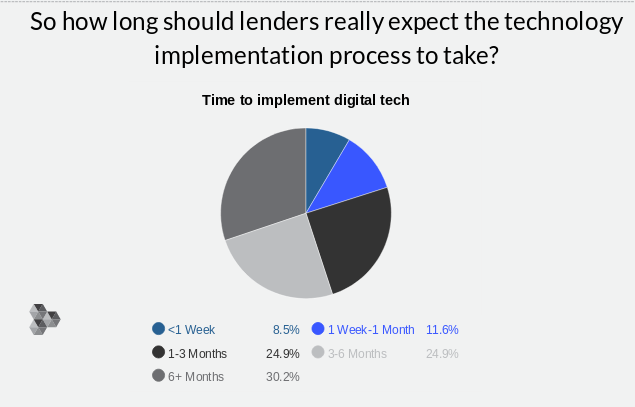

The survey found that 30.2 percent of lenders took greater than six months to implement digital mortgage technology. Another 24.9 percent took between three and six months, while the same number took between one and three months to implement the tech.

The survey also looked at the time it takes lenders of varying sizes to implement digital mortgage tech. Some 35 percent of companies with 101 to 500 employees took more than six months to do so, while 33 percent of lenders with 51 to 100 employees took between three and six months. Smaller lenders struggled to implement the technology any faster, with 37.5 companies of between 21 and 50 employees doing so within three to six months.