New home sales have fallen to their lowest level since the early days of the COVID-19 pandemic, suggesting that the housing boom could be coming to an end.

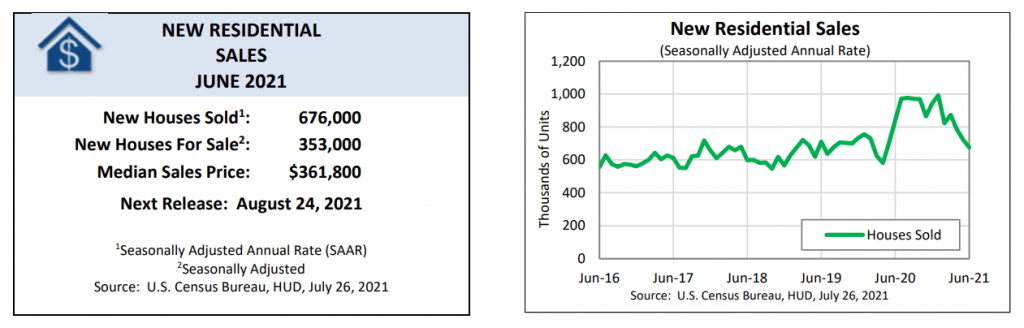

Data from the U.S. Census Bureau released Monday shows that new single-family home sales in June fell to a seasonally-adjusted rate of 676,000 units, down 6.6% from May’s rate of 624,000 new home sales. More saliently, that’s down 19.4% from June 2020’s level of 839,000, when the new home market first picked up pace amid the pandemic.

Analysts were shocked, as most had expected new home sales to grow by around 3% to 4%, CNBC reported.

The takeaway is that after a year of frenzied buying and some astronomical price gains, the new home market is now beyond the reach of most buyers even as demand remains high.

During June, the median price of a newly built home increased by 6% from the same period one year ago. While that might seem like a decent gain, analysts say it’s a sharp pullback from the 15% to 20% annual gains that were seen in previous months.

Experts say that most new home buying activity is now at the higher end of the market. That’s partly because home builders cannot afford to make more affordable homes. The reason is high material and labor costs. In particular, the sky-high prices of softwood lumber have been well documented. Lumber prices spiked 300% at one point during the pandemic, and while they have fallen back a little since, they remain 75% above the 2019 average. Other lumber products remain just as expensive, CNBC said.

Peter Boockvar, chief investment officer at the Bleakley Advisory Group, told CNBC that builders are afflicted by other problems including shortages of appliances, lots and skilled labor. “The moderation in home sales is likely a combination of sticker shock and the slowdown in the ability of builders to finish homes because of a variety of delays,” he added.

Because of the sales slowdown, the backlog of new homes is increasing. The Census Bureau’s report shows new home inventory rose from a 5.5 month supply in May to a 6.3 month supply in June. That compares to last fall, when supply sat at just 3.5 months. June also saw an all-time number of homes that have not yet been started.

Another possible factor in the new home sales slowdown is higher mortgage rates, analysts said. During June rates spiked by around a quarter of a percent, which might not sound like a not but could make a difference to thousands of potential buyers who were already stretched to the limit of what they could afford by the high prices of new homes.

The report also noted that permits, which are seen as a gauge of future construction, are less robust than the market needs. Single home starts posted a slight gain in the month, but only at the higher-end of the market.