Now is the most profitable time to sell, with rising home prices and most homeowners choosing to stay put for longer, those who do sell can generate much more profit now than they could at any time in the last decade, according to new data from ATTOM Data Solutions Q4 2017 Home Sales Report.

In the last quarter, home seller profits surged to a new ten year high, with an average home price gain since purchase of $54,000, up from $47,133 in Q4 of 2016.

The average seller profit of $54,000 reflects a 29.7 percent return on homeowner’s investments compared to the original purchase price. In other words, what we’re seeing is the highest average home seller return on investment since the third quarter of 2007,

Daren Blomquist, senior vice president at ATTOM Data Solutions, said that now is the most profitable time to sell a home in 10 years, though homeowners are choosing to stay put for longer than he’s ever seen.

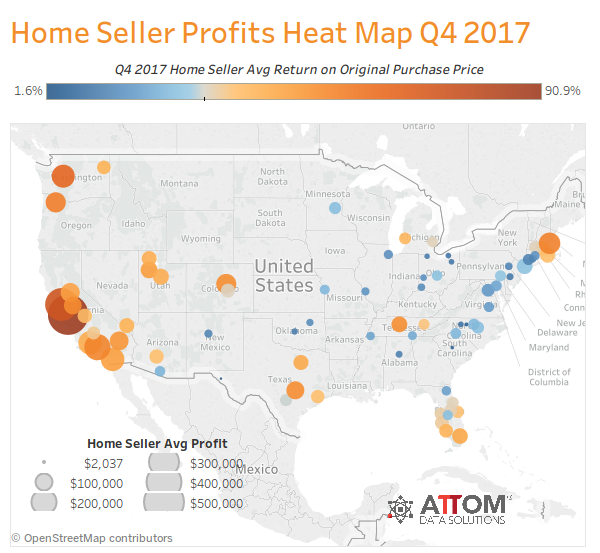

“While home sellers on the West Coast are realizing the biggest profits, rapid home price appreciation in red state markets is rivaling that of the high-flying coastal markets and producing sizable profits for home sellers in those middle-American markets as well,” Blomqvist said.

Among the 155 metro areas that ATTOM Data Solutions’ tracked, the locales with the highest average home seller ROI were: San Jose, Calif. (90.9%); San Francisco (73.3%); Merced, Calif. (64.6%); Seattle (64.4%); and Santa Cruz, Calif. (59.8%).

Meanwhile, homeownership tenure set a new record high in the fourth quarter of 2017. Homeowners who sold in the quarter had owned their homes on average 8.18 years, up from 7.78 years in the fourth quarter of 2016. It is the longest average home seller tenure since ATTOM Data Solutions has tracked it starting in the first quarter of 2000.