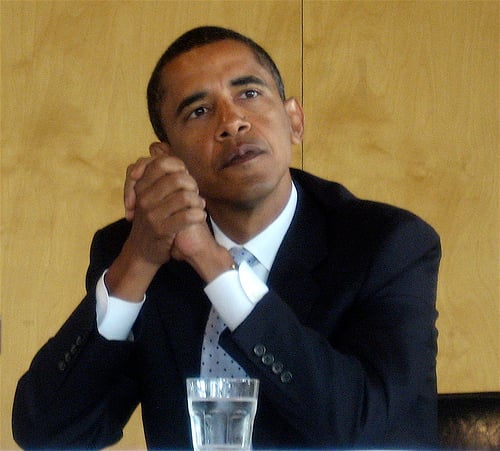

Image courtesy yeimaya via Flickr.com

President Obama pledged to keep the “American Dream alive” in his State of the Union address last Tuesday, outlining a number of efforts aimed at boosting America’s flagging economy and reviving its housing market.

HousingWire reported that Obama intends to submit a new plan of action to Congress in a bid to provide more aid to underwater homeowners so that they can refinance.

“No more red tape,” said the President. “No more runaround from the banks.”

Obama revealed that the legislation, which is designed to expand on the Home Affordable Refinance Program (HAMP), would be paid for by the country’s largest banks, which would be charged a small fee. The move follows previous efforts to widen access to the HAMP program – just last November, the Federal Housing Finance Agency (FHFA) removed barriers that prevented Fannie Mae and Freddie Mac borrowers from refinancing at today’s low interest rates.

There are nearly 11 million underwater borrowers in the US at present, and this debt amounts to approximately 22.5% of all outstanding loans in the country, according to data supplied by CoreLogic. Further, there are another 2.5 million borrowers holding less than 5% equity in their properties.

Obama has also promised to launch a new fraud task force to step up investigations into abusive practices by lenders which are thought to have led to the housing crash. The President said that his administration would “hold those who broke the law accountable”, whilst speeding up aid to homeowners.

A huge investigation was launched into alleged foreclosure abuses at major banks by a coalition of state Attorney Generals, together with the Justice Department and other federal agencies. Finally, after more than a year of investigations, a settlement appears to be close. Now, Obama wants the investigation to expand into issues of lending and securitization.

Eric Schneiderman, the New York Attorney General, will lead the new task force, after previously being removed from the negotiating table with banks when he tried to shift talks to problems of securitization and other issues.

Obama stated that some financial firms are guilty of anti-fraud law violations because repeat offenders are not penalized.