With consumers growing increasingly concerned about the economy and home prices increasing more, pending home sales slumped at the end of 2018, according to new data from the National Association of Realtors.

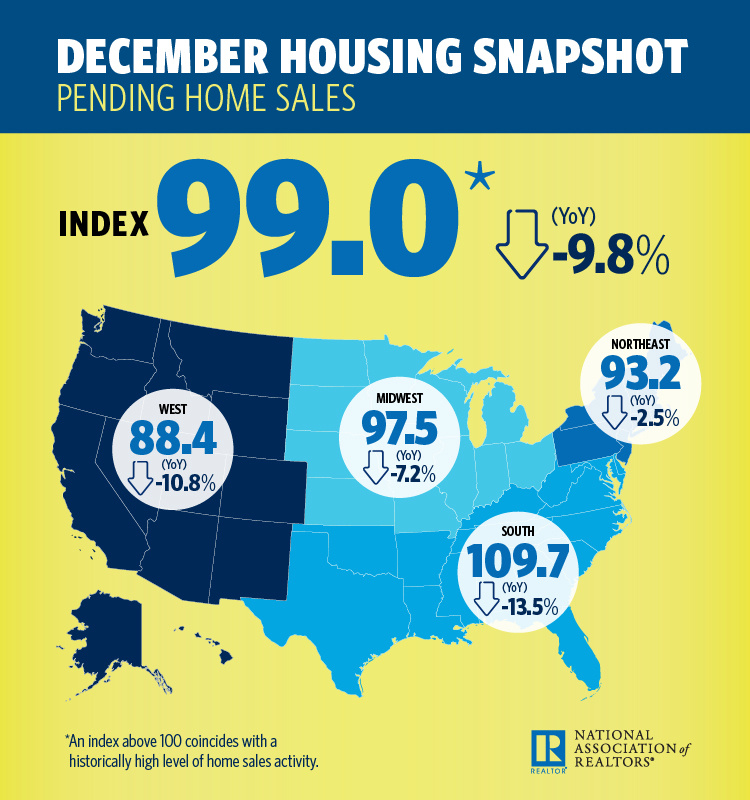

The NAR’s Pending Home Sales Index is said to be a key forward-looking indicator of real estate market activity, based on contract signings. In December, it decreased by 2.2 percentage points to a reading of 99. That means contract signings were down 9.8 percent in 2018, compared to one year before.

“The stock market correction hurt consumer confidence, record high home prices cut into affordability, and mortgage rates were higher in October and November for consumers signing contracts in December,” Lawrence Yun, the NAR’s chief economist, said in a blog post.

One bright spot however is that the record-breaking 35-day partial government shutdown that’s just ended did not have any significant impact on home sales, Yun said. He revealed that 75 percent of real estate professionals reported no impact from the government closure.

“However, if another government shutdown takes place, it will lead to fewer homes sold,” the economist warned.

Yun said that all four major regions in the U.S. showed declining contract signings compared to one year before, with the South being the most affected.

Still, Yun said he was confident that we will see home sales pick up in 2019.

“The longer-term growth potential is high,” Yun said. “The Federal Reserve announced a change in its stance on monetary policy. Rather than four rate hikes, there will likely be only one increase or even no increase at all. This has already spurred a noticeable fall in the 30-year, fixed-rate mortgages. As a result, the forecast for home transactions has greatly improved.”