More than a million Florida homeowners who have their properties insured by the Citizens Property Insurance group could be left facing a massive new bill if Governor Rick Scott goes through with his controversial plans to slim down the government-run insurers and make it a last-resort option only.

Citizens Property Insurance. Image courtesy of Docstoc

The plan, which will affect 1.3 million people in the state, would likely force Citizens policy holders to seek home insurance through private companies instead, which could cost significantly more than what they are paying now.

Governor Scott insisted abolishing Citizens was the last thing he wanted to do, but he said that it was necessary to reduce the size of the state-run homeowner’s insurance company, which is the largest in Florida.

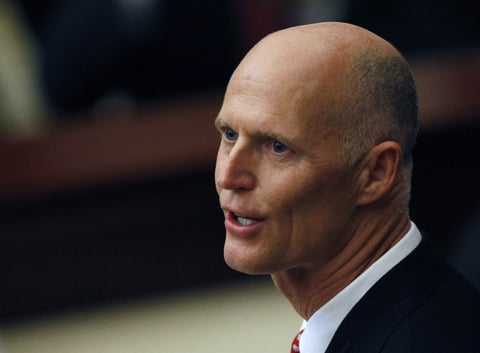

Governor Rick Scott. Image courtesy of here and now

Robert Norberg, an insurer based in Lantana, said his office had been deluged by calls from concerned homeowners in recent days. He says that more than 70% of new customers use the state funded insurer simply because private companies don’t want to risk getting involved in Hurricane-vulnerable Florida.

“People need Citizens,” says Norberg. “But does it need to be this big? Probably not, but with no alternatives, what are people supposed to do?”

Hurrican Andrew, 1992. Image courtesy of Sfu.ca

Citizens Property Insurance was established when dozens of big insurance companies pulled out of the state following the destruction of thousands of Florida homes by Hurricane Andrew back in 1992.

Mike Poutianen is a homeowner with Citizens insurance, and he has reservations about Governor Scott’s move. “I’m not necessarily against closing Citizens, but he has got to do something to get other insurance companies back in here,” he says.

However, Norberg thinks that is unlikely to happen. He also thinks that, with nearly one and a half million Citizens customers, Gov. Scott is unlikely to get his way.

“There simply isn’t anyone who is able to take on all those policies and do it successfully,” he said.

No one is thinking that the people can't continue to pay the already out of control Insurance rates. This legislature that my family and I helped put in office need to find a way to lower the cost of property insurance in this state or surly be voted out of office. We need the HELP from our elected officials to LOWER the out of control insurance rates !!

Citizens is the state-run insurer which allows them to charge substantially less than they should be charging because they can tax everyone after the storms hit. Their actuaries estimate that Citizens needs a 55% rate increase, but they are capped at 10% by law. That needs to change.

Private insurers have left the market because they can't continue losing money by charging artificially low premiums to try and competet with Citizens in a market that has the greatest hurrciane risk in the world. In many cases, Citizens premiums are much lower, and that's why they continue to grow. The real problem is that it obligates all Florida residents to paying assessments or "hurricane taxes" when the next storm hits, but most Floridians don't know how it can affect them. Those taxes could be substantial. Private insurers are required to have enough money in reserves to pay claims. They do not have the power to assess or tax consumers after the hurricane hits.

The only way we're going to get private insurer to come back into the market is to allow rate increases so they can charge what they need to charge. Otherwise, tehy have no incentive to come back to the Florida market - it would be a stupid business decision for them.