It seems that no matter how good or bad housing markets are performing, real estate fraudsters will always find some way to con homeowners out of their money. But scammers are doing particularly well out of the current economic downturn, taking advantage of hundreds of desperate homeowners, according to a report in MarketWatch.

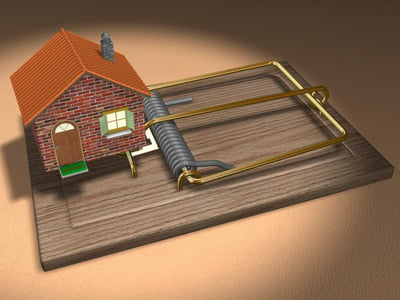

Scammers are coming up with inventive ways to trap desperate homeowners © Francesco Ugolini - Fotolia.com

Schemes involve targeting homeowners who are so desperate they’ll try just about anything to avoid foreclosure and save their home. Other types of real estate fraud target those who have opted for short sales to walk away from their delinquent mortgages.

A number of tactics will be used. Some scammers claim they can assist with loan modification claims by helping make sure the homeowner’s paperwork is in order. Others might pretend to be an attorney specializing in loan modifications. Scammers will come across as being completely plausible, dressing professionally and using similar language to what reputable companies will use – anything to get their mitts on desperate homeowner’s cash. Rarely do these people follow through with their offers of help.

Another common scam is to offer homeowners something called a quit-claim deed, in which ownership of the home is passed to the scammer. He or she will make promises that the homeowner can remain in the property, only to boot them out later. Alternatively, a more recent scam is to approach those who have already lost their home to foreclosure and claim they can help them get it back, for a small fee of course.

Yolanda McGill of the Fair Housing and Fair Lending Project of the Lawyers’ Committee for Civil Rights Under Law, says that the basic element in these cases remains the same. Scammers advertise a service, take the money and then vanish into thin air:

“It’s a crime of opportunity. A lot of people who are participating in this are probably long-term schemers and this is the cash cow right now.”

Short sales are also being targeted. According to CoreLogic, shady short sales could be costing lenders up to $375 million per annum. Short sale fraud occurs when the seller (or their representative) fails to notify their mortgage lender of the best offer they have had for their home. Scammers work with middlemen who snap up the home for a fraction of its value, before immediately selling it on to another bidder (who the bank wasn’t told about) at a profit, pocketing the difference.