Property Partner, the property crowdfunding platform that allows anyone to invest in residential property at the click of a button, today announces the successful completion of a $22.4 million funding round, taking the total amount invested in the company to $31.7 million.

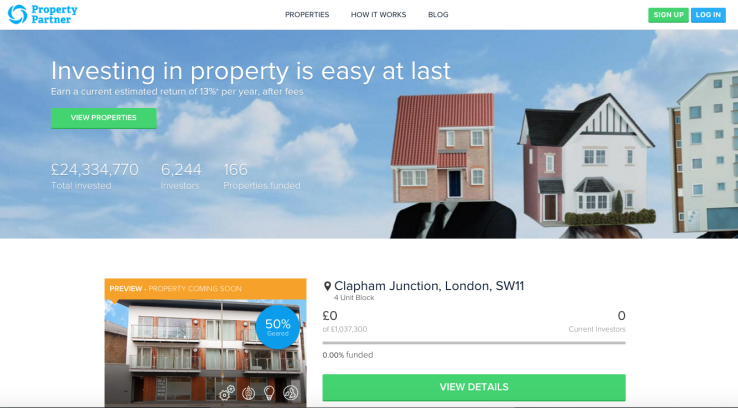

Launched barely a year ago in January 2015, Property Partner already boasts more than 6,200 customers, and has been recognized by KPMG as one of the world’s top 50 emerging Fintech companies.

Property Partner’s mission to make property investment available to all has now received a substantial boost, after it became one of just a handful of European Fintech firms to successfully secure ‘Series B’ funding. The investment round is being led by Octopus Ventures, with participation from Index Ventures and Dawn Capital.

With one property launch per week, Property Partner is already one of the most active buyers in the UK residential market. Investors earn an estimated return of 13% per annum, after fees — free from all the hassles of conventional buy-to-let.

Through the power of the crowd Property Partner is making the property market better: not just for investors but also for tenants, first time buyers and housing supply. Tenants receive a professional rental experience, aspiring first time buyers track the housing market with their deposit savings, and small developers get improved cash-flow to accelerate property transactions, increasing housing supply.

But what makes Property Partner completely unique is its flourishing resale market. This property ‘stock exchange’ allows investors to buy, trade and sell their shares on the platform. With £4.7 million shares already traded, Property Partner is bringing a hugely valuable measure of liquidity to the residential asset class.

“This significant investment is a huge vote of confidence in our business model, and our vision for making the property market better for everyone," said Dan Gandesha, CEO, Property Partner. "These funds will help propel us towards our ultimate goal – that of being a global stock exchange for property.”

Property Partner will use this investment to expand across the board. Plans are in place to grow the customer base by developing new segments, including institutional investors. Exciting new products, such as shared ownership, are in the pipeline. The funding will help Property Partner attract the best talent to join an expanded team, to bring its unique, revolutionary product to the widest possible market – here in the UK, and beyond.

“The £5.75 trillion UK property market, with the exception of pioneers such as Zoopla, has been slow to embrace technology," said Jo Oliver, Investment Director at Octopus Ventures. "However, this is now changing rapidly and Property Partner is one of the companies leading this disruption. Through its combination of technology, business model and excellent management execution Property Partner is dramatically increasing and improving the accessibility of property as an investment asset class."