Real estate crowdfunding is a growing industry of great interest for realtors and investors. A report on Crowdfunding for Real Estate by crowdsourcing.org anticipated a $3.5 billion growth for real estate crowdfunding in 2016, and experts project that the industry will grow to over $300 billion by 2025.

Just keep in mind that, according to Dr. Richard Swart, UC Berkeley's crowdfunding research director, "property crowdfunding is riskier than traditional investments."

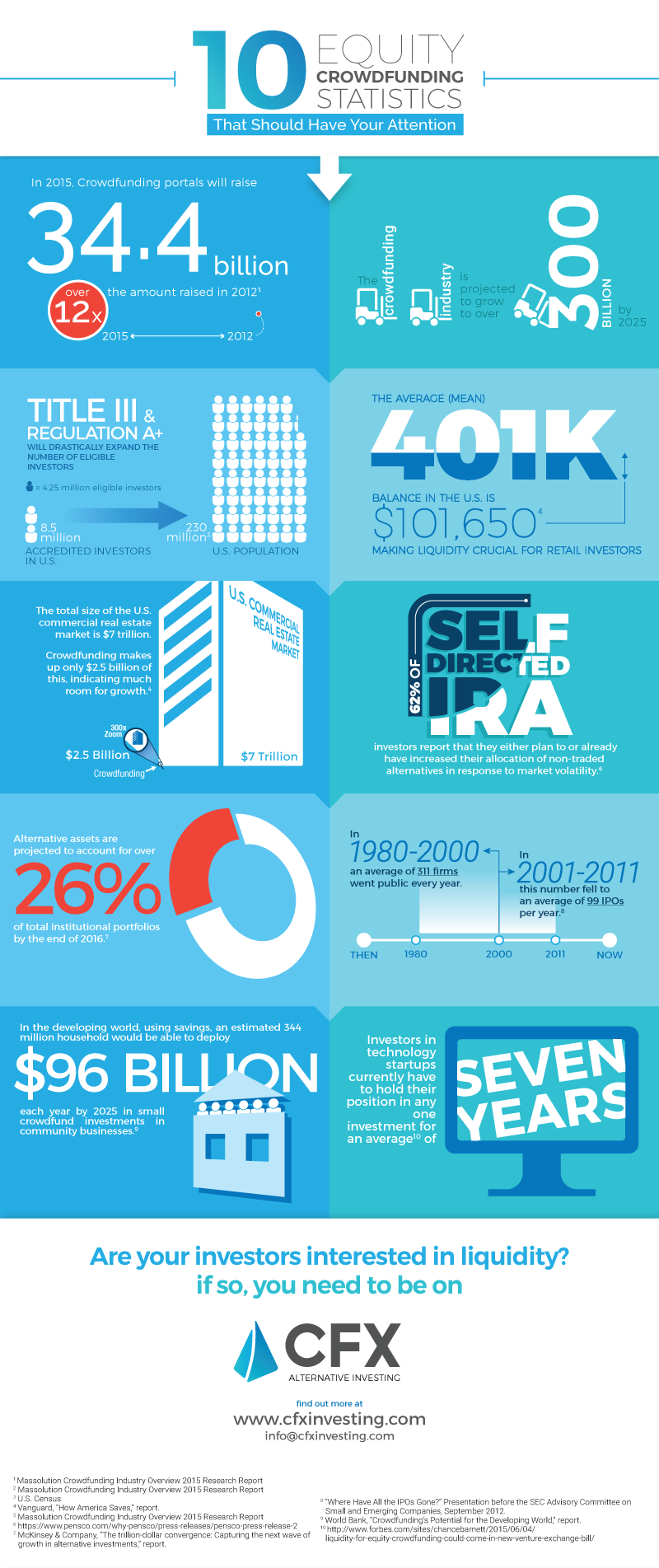

CFX Markets infographic: "10 Equity Crowdfunding Statistics that Should Have Your Attention"

According to CFX Markets, crowdfunding makes $2.5 billion of the total size of the U.S. commercial real estate market, which is $7 trillion. This indicates a huge potential for growth in the following years. Because it is a relatively young trend, crowdfunding for real estate is projected to grow in 2018, as more people learn of its potential.

crowdfunding (noun: crowd·fund·ing \ ˈkrau̇d-ˌfən-diŋ \) is defined by the Merriam Webster dictionary as "the practice of obtaining needed funding (as for a new business) by soliciting contributions from a large number of people especially from the online community."

People use crowdfunding for a diversity of startup projects, including artistic and creative projects, social entrepreneurship projects, and so on. Similarly, crowdfunding can now also be used to secure real estate loans, residential debt investments, commercial equity investments, 1031 exchanges, and so on.

There are already several sites specializing in crowdfunding for real estate. In 2018 these will get stronger, while others will emerge to take advantage of the growing trend. Below are some of the top real estate crowdfunding sites you could be using right now:

ArborCrowd is unlike typical real estate crowdfunding platforms in that all its offerings so far have involved passive equity interests in apartment properties. Other platforms typically offer their investors – the crowd – opportunities to buy into preferred equity or some debt instrument, typically a second mortgage. Such investments provide cash flow from the start, making them an easier sell.

"We believe everyone should be able to invest in real estate. We challenged ourselves to come up with a solution that could give everyday investors a chance to access those inaccessible real estate investments at a fraction of the investment minimum," said Allen Shayanfekr, Sharestates CEO

There are many other real estate crowdfunding sites you could choose from. The top compiled by The Real-Estate Crowdfunding Review can be instrumental in helping you pick the best. What's interesting is that this top also shows you how the industry grows, which crowdfunding sites for real estate are getting stronger, which have poor investor protections, inadequate volume, hidden fees, and much more. They also have excellent investment tutorials, news and interviews, and other useful resources.

Accredited investors are not the only ones who can enjoy the benefits of crowdfunding. There are already sites that offer crowdfunding for prospective homeowners and 2018 will see more.

HomeFundMe was launched by mortgage lender CMG Financial in October 2017. The site is designed to help first time home buyers, millennials with high levels of student loan debt, couples who want to build their wedding registry, and so on. HomeFundMe is the first approved crowdfunding platform designed for the down payment on a home.

"Our tagline is, 'Fund your way home.' We think homeownership still is very sensible and, done correctly, is a good idea to step forward toward wealth, stability and quality of life," said Christopher George, CEO of CMG Financial and vice chairman of the Mortgage Bankers Association.

Millennials use apps more than they use desktops and laptops, therefore it makes sense for crowdfunding sites to offer an app version of their platforms. Crowdfunding sites offer mobile versions of their platforms, but apps dealing with crowdfunding for real estate are hard to find. In 2018 you can expect developers to launch crowdfunding for real estate apps as the trend grows.