These days many folks with cash savings, CD's or IRA's are in search of ways to increase their returns. Interest rates for bank CD's, savings accounts, money market funds and IRA's are just not what they used to be. Seniors who are accustomed to having income from interest paid on savings have seen their income go down along with the prevailing interest rates being paid on most traditional investments. As a result, many folks are considering non-traditional investments, because of the potential for higher interest income.

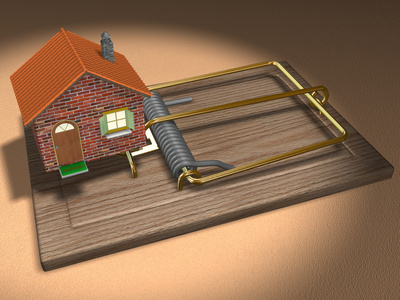

Avoiding real estate investment scams © Francesco Ugolini - Fotolia.com

One of the best known of these non-traditional investments is private lending for real estate. Today's tight credit markets and lack of readily available funding has led to a new wave of real estate investors who are seeking private capital from individuals to help fund a variety of real estate projects such as buying and fixing foreclosures.

While I certainly do support the idea of using private funding and have used private funding frequently, there are certain things that the "lender" should be aware of before deciding to invest any capital with an individual real estate investor or small investment company.

I've run across several honest, sincere real estate investors who had no intention of committing a crime with someone else's money. But after making a few major mistakes, they ended up committing a major crime by taking funds from more than one lender for the same piece of property. They started out expecting to make money, but in the end, wound up losing lots of it.

One case in particular involved someone that I knew and worked with in the early years of my investing career. A former executive for a major fortune 500 company, this guy was bright, well educated and quite experienced at raising funds from private lenders. He had successfully completed dozens, perhaps hundreds of transactions using funds borrowed from various individuals. He also had an excellent reputation for paying back his lenders as promised. But when the housing boom began to bust, he ran into trouble.

In order to keep his business afloat he needed more funds, but he was having trouble finding suitable properties to secure the money he desperately needed. So he decided to create a funding "opportunity" in which he would use the same residential property as "collateral" for multiple lenders.

Each lender was told that they would have a first mortgage on the property as security for their loan. None of the lenders knew that other lenders were being told the same thing. Eventually there were about a dozen phony first mortgages on the same piece of property. I'm sure that this investor thought he could work his way out of the problem if he could buy enough time.

But the housing market tanked, and the investor ran out of time. Once it came to light that he had misled multiple lenders about the collateral for their loans, the legal wrangling began. It became a big legal mess, since private borrowing and lending is pretty much a "buyer beware", unregulated business. Just because the lenders were misled, did not automatically result in the arrest of the investor. But the whole scenario could have been avoided had each of the private lenders involved done the proper follow up to insure that the deal was being handled as represented by the investor.

A title search may have quickly shown a problem, if there were multiple mortgages recorded against the property, or if none of the mortgages were being recorded. Either way, it could have been checked out and discovered well before multiple lenders got involved. But no one did. The lenders simply assumed that the deal was being handled as represented by the investor. This made it much easier for him to continue with the fraud until a dozen different lenders were involved. Like Bernie Madoff, if not for the tanking of housing and credit markets, this fraud might have turned into a ponzi scheme that could have continued for years.

When considering lending your savings or IRA money to another investor, be sure you understand exactly what their investment plan is, when you can expect to get your money back, and how much you will be making on the deal. If you do not understand any details, or the answers you are getting are vague, move on. Warren Buffett famously said that he never invests in any business if he does not understand how they make their money. When it comes to private lending, this is great advice. Investors who are planning to defraud you often make you feel like the plan is simply over your head or too advanced for you to understand.

Ask to see a copy of the appraisal and make sure it is a valid appraisal. The easiest way to do that is to drive by the property you are lending on, and then check out the comparable properties used for the appraisal. No appraisal? No loan - unless you know your market and can verify the property value for yourself. This is one of the most common ways to commit real estate fraud with a private lender. The lender fails to verify the actual value of the property before lending money.

Insist on a copy of the recorded property records, including your mortgage note and the deed, and verify that they are correct. Find out what attorney is handling the closing and make sure that you have your own attorney check out the paperwork if you are not familiar with these procedures yourself. Do not fund a transaction until you are satisfied that everything is in order. At times, the closing attorney or title agent has been in on a scam, providing legal cover for a fraudulent scheme.

Your note and mortgage should be recorded within 30 days of closing of escrow, and you should expect to receive a copy showing the recording stamp from the clerk of the court. Check to make sure that they were actually recorded. When an investor does not record your mortgage in a timely fashion that is a definite red flag.

Finally never assume that your investment will be safe. Even pros can make mistakes then panic and try to cover their tracks. And cons will be long gone before you realize you've been had.

Private lending of your savings, secured by real estate can be an excellent way to increase your income when done correctly. The first rule of thumb is always check out the details. Many folks like to be "hands off" but this opens the door to the potential for fraud. Smart lenders make sure that they know what is going on with their money.

---------------------------------------------------------------------------------------

Donna S. Robinson is a 17 year veteran of the real estate industry. Follow her on twitter at donnaconsults. Her website is Realty Biz Consulting

I think everybody should check out the Scam Detector app. I believe they're online as well.