Single girls are losing out to single guys when it comes to housing, according to a new study by RealtyTrac, which found that single men’s homes have appreciated in value more than those of single women.

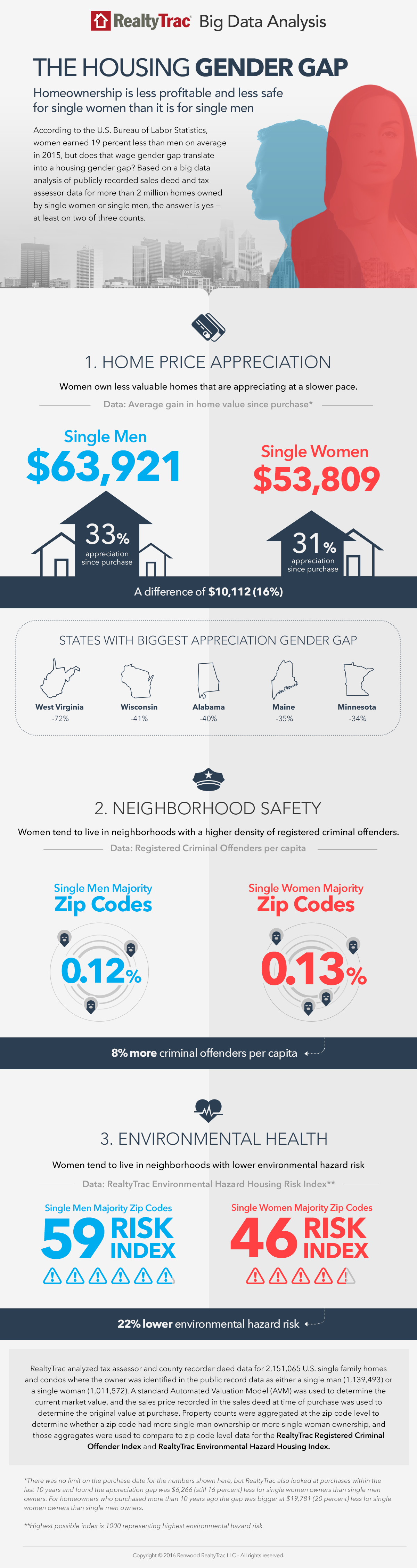

RealtyTrac says that homes owned by single men are worth an average of $63,921 more from the time of purchase to the present, than those owned by single women. That means single men have seen a 33.4 percent return on their investment, while women’s homes have only appreciated by $53,809, a 30.7 percent return on the purchase price.

One of the main reasons for this is that women earn less money than men, and so they usually buy less expensive properties which appreciate more slowly, said Daren Blomquist, SVP at RealtyTrac.

“Women earn less than men on average — 19 percent less in 2015 according to the Bureau of Labor Statistics — giving them less purchasing power when it comes to buying a home,” said Blomquist. “So it’s not surprising to see the 10 percent gender gap in average home values between single men and single women homeowners; however, the slower home price appreciation for homes owned by single women demonstrates that less purchasing power is also having on a domino effect on their ability to build wealth through homeownership as quickly as single men.”

RealtyTrac points to statistics that show women who work full-time earn just 79 percent of what men working full-time earn. Over a forty year career that wage gap means women earn $430,480 less than men, which means they have less purchasing power.

Another factor is that single women tend to pay more interest on their mortgages. The average single woman pays 0.4 percent more interest, according to a 2011 study published by the Journal of Real Estate Finance and Economics. That may seem like a very small number, but over the course of a 30-year mortgage it amounts to around $26,000 more, assuming a man gets an interest rate of 5 percent and a women gets an interest rate of 5.4 percent. The study authors say that this is due to women tending to choose lenders based on recommendation, while men tend to search for the lowest possible rates.

That’s not to say that all single female homeowners are losing out. Blomquist says there are many women who have seen their home values appreciate greatly, and “in some markets homes owned by single women are actually outperforming homes owned by single men in terms of the return on investment”, including Washington D.C., New Jersey, Virginia, Nevada, Pennsylvania, and New York.