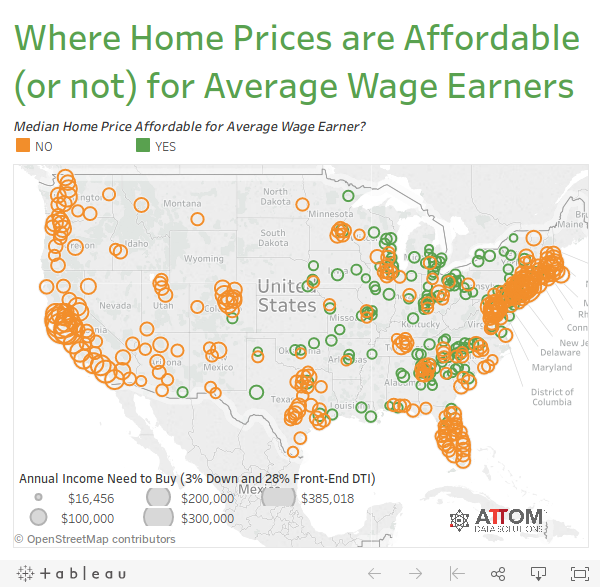

Houses are becoming more unaffordable across the country, not just in the coastal markets. According to new data from ATTOM Data Solutions, the median home price was not affordable to the average wage earner in 68 percent of counties during the first quarter of 2018.

ATTOM determines home affordability by calculating the amount of income necessary to make the monthly payments on a median priced home, including the mortgage payment, property taxes and insurance. Researchers also factor in an assumed down payment of 3 percent and a 28 percent maximum debt-to-income ratio.

“Coastal markets are the epicenter of the U.S. home affordability crisis, but affordability aftershocks are now being felt further inland as housing refugees migrate from the high-cost coastal markets to lower-priced markets in the middle of the country where good jobs are available,” said Daren Blomquist, senior vice president with ATTOM Data Solutions. “That in turn is pushing home prices above historically normal affordability limits in those middle-America markets.”

ATTOM’s latest report shows that 41 percent of 446 U.S. counties it analyzed in Q1 were less affordable compared to their historic affordability averages, up from just 24 percent one year ago.

However, 59 percent of U.S. counties are still more affordable than their historic averages.

Whether things will stay that way remains to be seen, but the outlook is not promising as 73 percent of counties saw a year-over-year decrease in their affordability index. What this means is that home prices are more expensive in 73 percent of counties than they were just one year ago. One factor behind this is that wage growth is being outpaced by home price appreciation in 83 percent of housing markets, ATTOM said.

In turn, the growing unaffordability is causing some residents to leave more expensive markets. The report shows that 8 of the top 10 counties with the highest median home prices saw more residents leave in the first quarter. For example, Kings County (Brooklyn), N.Y. posted a net migration decrease of 25,484; Santa Clara County (San Jose), Calif., saw a 5,559 net migration decrease; New York County (Manhattan), N.Y., posted a 3,762 net migration decrease.