Consumers who choose to use an iBuyer to sell their home often end up paying much higher fees than they would have if they’d gone with a traditional real estate agent, according to new research from Collateral Analytics.

iBuyers are companies that provide instant cash offers and quick closings on a home, which can be a considerable advantage for some sellers. Indeed, iBuyer transactions have been growing at around 25% a year since the concept first emerged in 2014 with the launch of Opendoor. But, the convenience of selling to an iBuyer may be more expensive than many sellers realize.

In its research, Collateral Analytics looked to quantify the cost of selling via an iBuyer versus that of a traditional real estate agent. Its report estimates that sellers typically end up paying between 13% and 15% more when working with iBuyers. This extra cost comes by way of increased agency fees, plus an allowance that iBuyers usually request for repairs, and an extra 3% to 5% on top to cover their liquidity risks.

“Most iBuyers will inspect the home, assess a generous home repair allowance, and negotiate (an additional) credit to handle such repairs,” the Collateral Analytics report noted.

Some iBuyers do give back a little though. For example, companies like OfferPad will pay for the costs of the seller’s move, so long as it’s within 50 miles of their old home. iBuyers often also provide an extended grace period for the seller to vacate the property after closing, the report found.

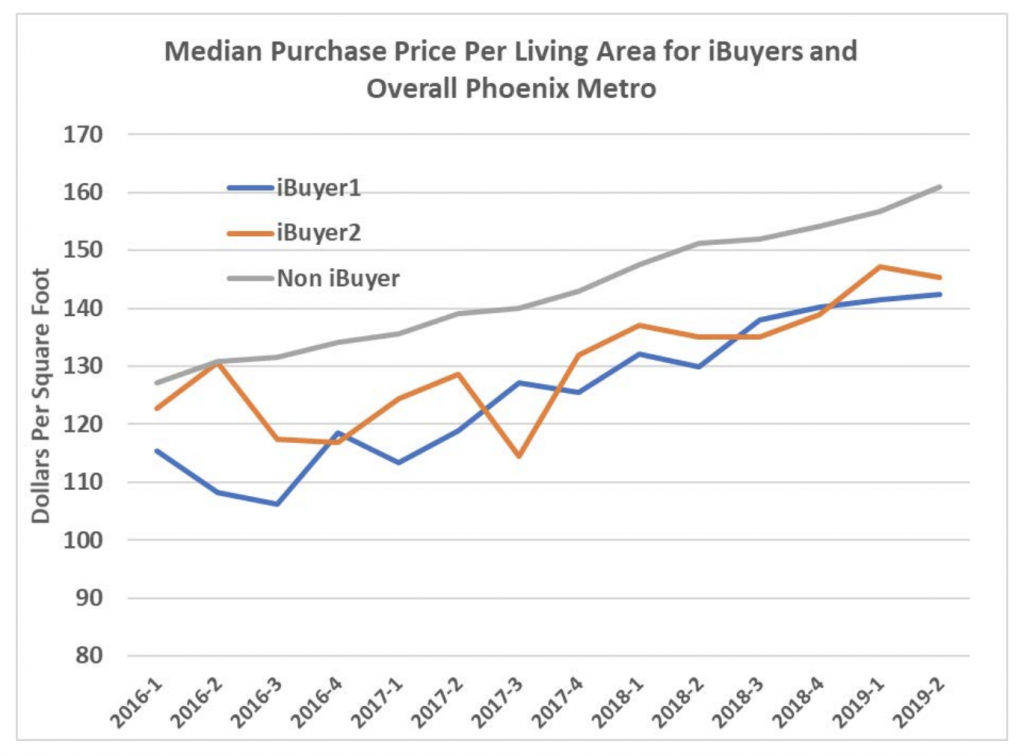

Collateral Analytics published the above chart showing a comparison of quarterly median purchase prices on a per-square-foot basis for single-family homes in Phoenix, between iBuyers and traditional buyers. Phoenix was chosen as it’s currently the most popular market for iBuyer transactions. The chart shows that iBuyers often pay around $10 to $20 less per-square-foot.

Collateral Analytics noted other risks in its report, including that iBuying’s use of automated valuation tools could help to inflate property values. In addition, it noted that properties bought by iBuyers often remain empty for several weeks after purchase, leaving them more vulnerable to theft and other criminal activity.

Still, there’s no doubting the popularity of iBuyers, and the concept is getting some big money backing from investors. Opendoor, the original iBuyer, has raised $1.3 billion since its launch and bought over 10,000 homes in 2018 alone. That’s three times more homes than its main rival, OfferPad. And in recent months, real estate brokerages have been trying to get in on the act, with companies including Keller Williams, Coldwell Banker, Redfin and Zillow all dipping their toes into the market.

“For some sellers needing to move or requiring quick extraction of equity, this is certainly worthwhile,” Collateral Analytics said in its report. “But what percentage of the market will want this service remains to be seen.”