Freddie Mac has warned that the rising cost of child care services in the U.S. could force many low-income earners to put off their plans for homeownership.

In a new analysis published this week, Freddie Mac officials reported that U.S. childcare costs have risen by an average 49% over the last 25 years, while the cost of housing has increased by just 14% in the same period.

Freddie’s researchers found that the average U.S. family spends $715 per month on child care, rising to $758 per month if the parent with the most childcare responsibilities (usually the mother) is also employed.

Families with younger children aged four or less spend an average of $948 per month on childcare, the report added.

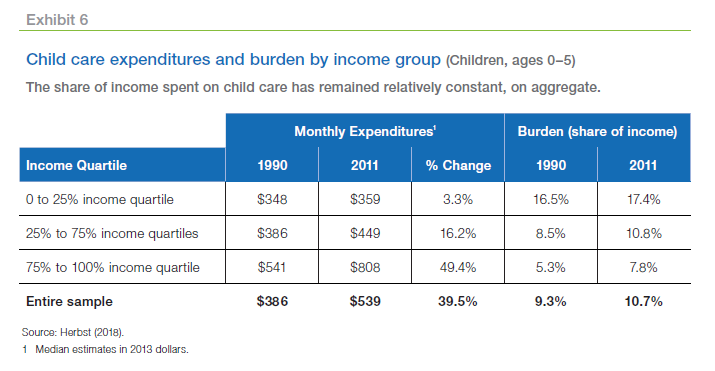

Of course, the impact of rising child care costs is felt most keenly by lower-income families, Freddie’s researchers said. A family that’s making less than $1,500 per month would need to spend an average of 40% of their income on childcare, while a family that makes over $4,500 per month would spend just 6.7% of their income.

Freddie Mac’s chief economist Sam Khater said families today face a never-ending list of expenses and that presents challenges for both renters and homeowners. However, he said the burden of childcare is one of the biggest challenges of all, considering its high cost relative to people’s incomes.

“Our analysis finds that those families paying for child care generally are left with less money for housing,” Khater said. “Specifically, we find they, on average, pay about half of the median mortgage payment and nearly 80% of the median rent.”