Saving up for a down payment on a home takes time, we all know that. But how much time exactly? A new blog post on Builder Online sheds some light on the matter.

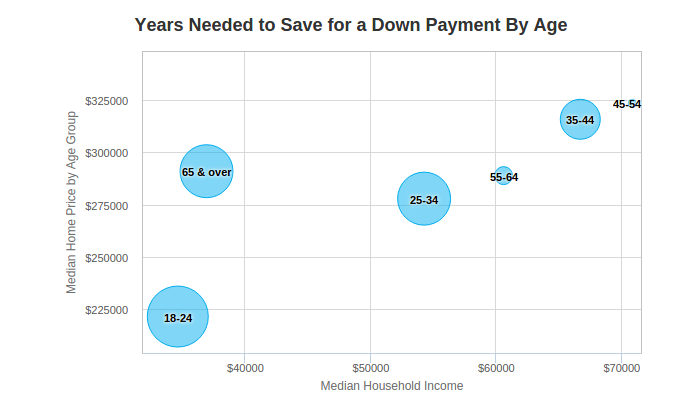

It looked at data from the national Census and Metrostudy, and came up with the average length of time it takes each generation to save up the 10 percent down payment needed to buy a home, based on the median home price and median household income for each demographic.

Not surprisingly, it's millenials who'll have to wait longer than anyone else. People from the youngest house buying generation – those aged 18 to 24 years now – will have to wait around 8.77 years on average before they can put down on a deposit for a home valued at $221,600.

On the other side of the coin, Builder Online found that those aged between 45 and 54 years old, who're usually at the peak of their earnings power, have the shortest wait at just 3.54 years if they want to buy a home valued at $291,000. They're followed by those aged 55 to 64 years, who would have to wait 3.72 years on average.

There's also bad news for retirees – those aged 65 years and over – who, if they're setting out at that late age, will have to wait 7.37 years before they can front up the down payment.

Here’s a quick overview of how long it should take the various age groups to save up for a down payment: