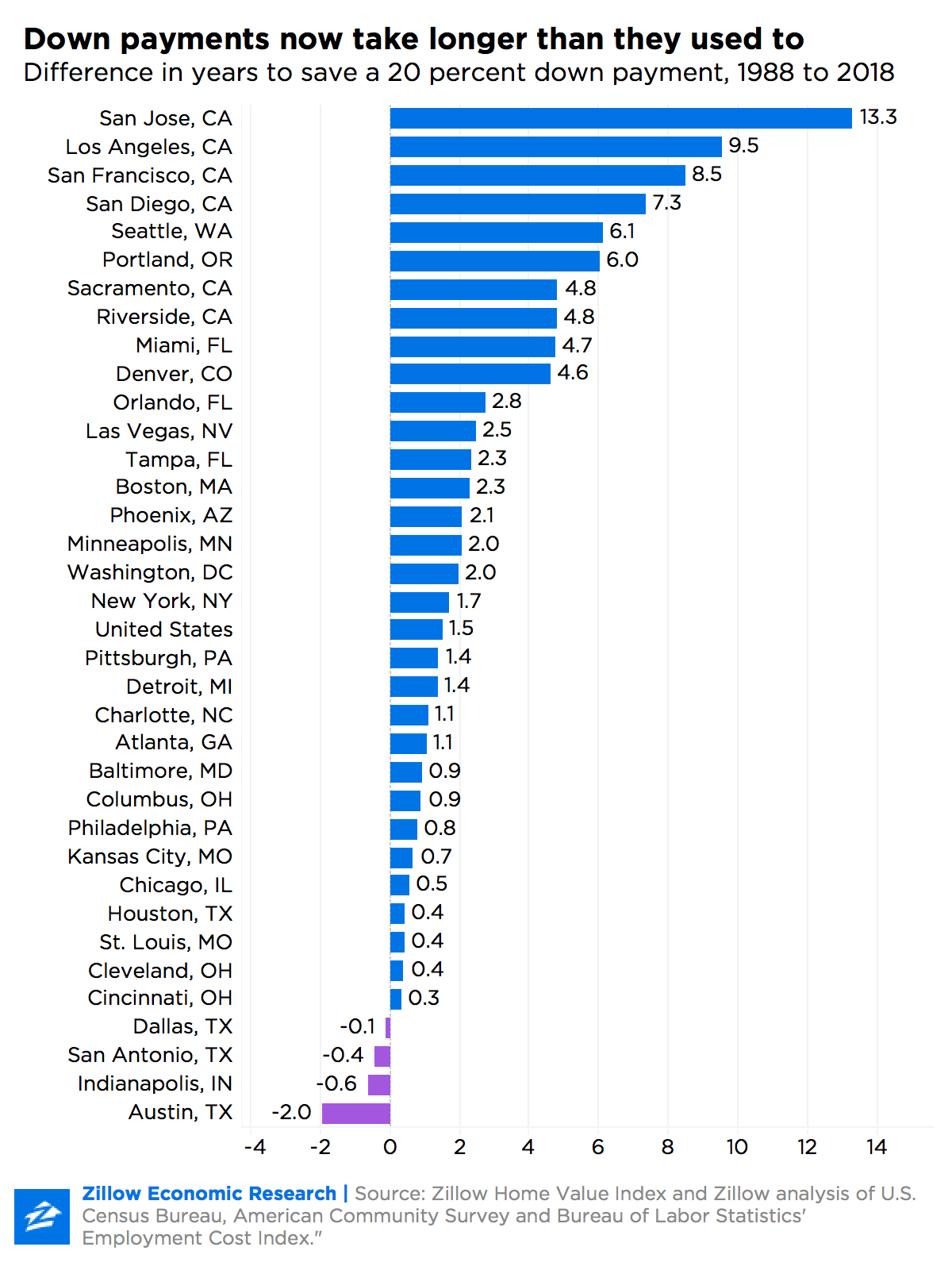

With homes getting more expensive, it's taking longer and longer to save for a down payment.

For someone making the median income and putting away 10 percent each month, it would take just over seven years to save for a 20 percent down payment on the typical U.S. home, according to a new Zillow analysis. It hasn't taken this long to save for a down payment since early 2008, shortly after home values hit their highest point during the mid-2000s housing bubble.

Home values have seen strong, steady growth since the housing crisis, and nationally the typical home is worth more than ever. Although home value appreciation has slowed in recent months, homes are still gaining value faster than incomes are growing. Saving for a down payment is one of the biggest barriers to owning a home, according to the Zillow Housing Aspirations Report, and when home values outpace incomes, it gets steadily harder to reach that goal.

Twenty years ago, it took 5.5 years to save for a 20 percent down payment. Since then, home values have grown nearly twice as much as incomes have, increasing by 98.6 percent, while incomes have risen 52.6 percent.

"The simple fact that home values have far outpaced income growth, lengthening the time needed to save for a down payment, contributes to millennials' struggles to enter homeownership. Saving up for a down payment can be tough, especially when the cost of everyday life outpaces the money you put into the bank. It requires good budgeting and long-term planning. It's one reason why more and more first-time home buyers are looking to family and friends for financial help when coming up with their down payment," said Zillow Director of Economic Research and Outreach, Skylar Olsen. "Slower rent growth in recent months should create some more breathing space in renters' budgets, but rents remain high by historic standards. Even if you don't have plans to buy a home in the next year or two, it's not a bad idea to start setting aside savings for a future home purchase. It's also important to remember that there are many options for mortgages requiring less than 20 percent down."

The length of time it takes to come up with a down payment strictly from saving may be a factor in why 43 percent of the typical down payment comes from saving over time, with buyers relying on other sources such as the sale of a previous home or a gift from family or friends for the restii.

Relying only on savings, it takes longest to save for a down payment in San Jose, Calif. Although the median household income is highest in San Jose ($118,061), it would take about 22 years of saving to come up with a 20 percent down payment for the median home, worth $1,287,600.

It's fastest to save for a down payment in Pittsburgh, where it takes 4.8 years to save for a 20 percent down payment.