Every single one of the U.S.'s 50 largest cities now has more renters than it did 10 years ago, according to a new Zillow analysis. The real estate listings and analysis company said there are more renters in 2016 than there were in 2006 in each of the 50 largest metros, with Memphis, Tennessee; Las Vegas and Honolulu seeing the greatest increase in renters.

The report notes that more than a decade ago during the Great Recession, millions of homeowners were foreclosed upon and many have yet to purchase a home again. Numerous households became renters at the same time that tight mortgage lending standards and a weak labor market made it harder for young adults to become first-time homeowners.

Even as homeownership slowly climbs back today, rapidly rising home values often make it difficult for younger renters to save enough break into the housing market to begin with. In 2006, 31 percent of all U.S. households rented; today, over 36 percent of all households rent. In 2000, prior to the housing boom, about 33 percent of all households were renter households.

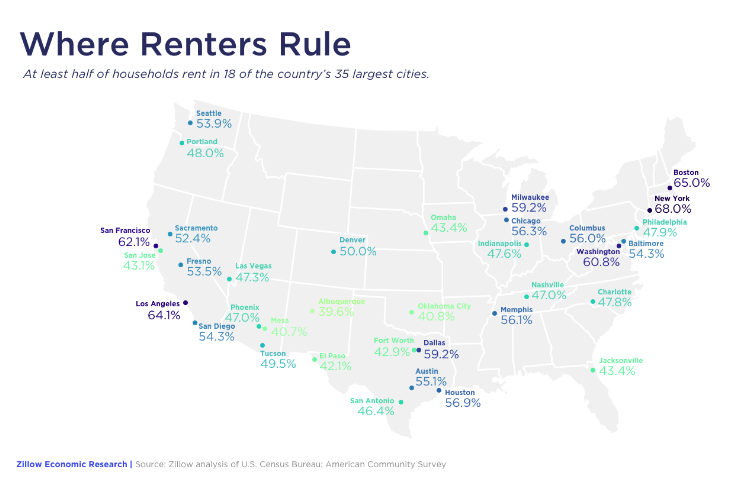

In Memphis, 56 percent of all households are renter households, up 11 percentage points since 2006. The renter rate in Las Vegas is just over 47 percent, up from 38 percent 10 years prior.

Home values across the country are rising over 8 percent annually, with some markets reporting double-digit home-value appreciation. The median home value in the San Jose, Calif. metro rose 27 percent over the past year, with 43 percent of all households renting, up about 5 percentage points since 2006.

"The share of U.S. households that rent surged in the wake of the Great Recession, as millions of families were foreclosed upon and younger adults either chose to or had no choice but to rent for longer," said Zillow senior economist Aaron Terrazas. "Renting remains more common years after the recession ended and after a historically long national economic expansion."

The majority of people rent instead of own in 29 of the 50 largest U.S. cities. In 2006, only 16 of the 50 largest cities were majority renter households.

Miami, New York and Boston have the greatest share of renter households. Almost 70 percent of all households in Miami and New York, and 65 percent of all households in Boston, rent. The renter rate in Miami rose 6 percentage points over the past 10 years.

Virginia Beach, Va., Albuquerque, N.M., and Mesa, Ariz. have the smallest share of households who rent. The renter rate in Virginia Beach is 37.8 percent, and is about 40 percent in Mesa.

The median rent across the U.S. is $1,440 per month, up 1.3 percent over the past year. According to the 2017 Zillow Group Consumer Housing Trends Report, millennials say one of the greatest barriers to homeownership is saving enough money for a down payment. Other struggles include qualifying for a loan and determining how much home they could afford.