New analysis shows that the town of Clayton, Georgia, in the Atlanta metro area is now the single best bet for real estate investors, offering the highest returns from single-family rental properties in the entire country in 2017.

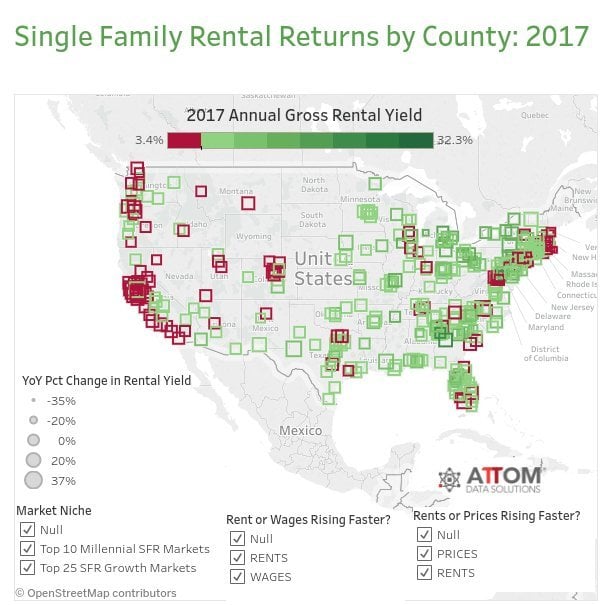

The data comes from ATTOM Data Solutions' latest Q1 2017 Single Family Rental Market report, which analyzed single-family returns in 375 U.S. counties with populations of 100,000, and in 6,000 zip code areas that have a population of 2,500 people or more.

Clayton, Georgia isn't the only prosperous market for investors however. Other counties offering exception yields include Baltimore City, Md.; Bibb County, Ga., in the Macon metro area; Monroe County, Pa., in the East Stroudsburg metro area; and Saginaw County, Mich., the report showed.

As for counties with a population of at least one million, Wayne County, Mich., in the Detroit metro area; Cuyahoga County, Ohio, in the Cleveland metro area; Allegheny County, Pa., in the Pittsburgh metro area; Philadelphia County, Pa.; and Franklin County, Ohio, in the Columbus metro area came out on top.

Across the 375 counties ATTOM Data Solutions tracked, the average annual gross rental yield was 9 percent so far this year. ATTOM divided the annualized gross rent income by the median purchase price of single-family homes to obtain its data.

“While good returns on single-family rentals are hard to come by in high-priced coastal markets and in some other housing hot spots such as Denver and parts of Dallas, Austin, and Nashville, solid returns on single-family rentals will continue to be available in many parts of the Southeast, Rust Belt, and Midwest for investors purchasing in 2017,” says Daren Blomquist, senior vice president at ATTOM Data Solutions. “And single-family rentals should continue to yield strong returns in many parts of the country going forward given the market undercurrents of low rent-ready housing inventory and low homeownership rates.”

Blomquist added that average fair-market rents rose in 2017 in 86 percent of the markets his team analyzed, even while average wage growth outpaced rent growth in 67 percent of markets—“a recipe for sustainable growth in the rental market.”