Home buyers wish the process of obtaining a mortgage could be both faster and less confusing. But at the same time, they’d also like more personal interaction as they navigate through a transaction that is often one of the biggest financial decisions they’ll ever make in life, according to Fannie Mae’s new National Housing Survey.

“As the Amazons and Ubers of the world continue to raise the bar for ‘consumer-grade’ experiences, home buyers have made it clear that it’s also time for the home purchasing and mortgage processes to change,” writes Henry Carson, senior vice president of digital products, at Fannie Mae’s Perspectives blog.

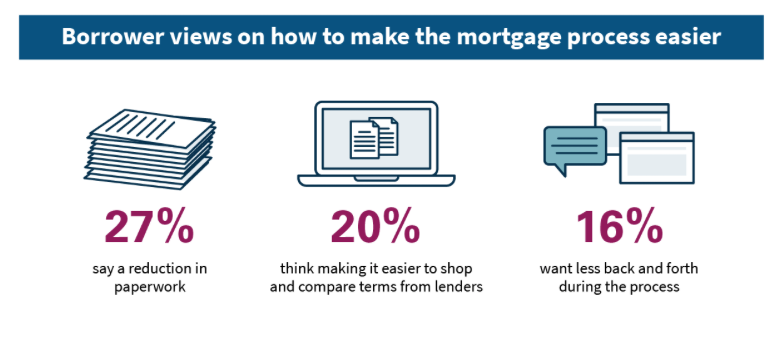

The biggest takeaway from the survey is that borrowers would like less paperwork. They said the most difficult part of the application process is gathering all of the financial documentation needed, and that it was more difficult for those aged 45 or those who’ve previously bought a home.

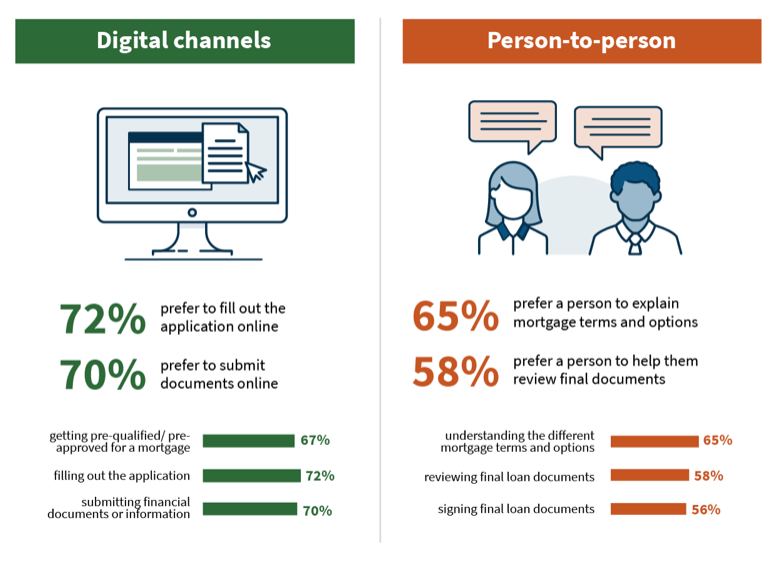

Borrowers were also asked if they’d prefer the mortgage application process to be fully digital, with each step completed online. Most said they were “very” or “somewhat” interested in that.

However, borrowers were more receptive to digitalization if it means speeding up the application process. Most respondents agreed they’d like to see the process completed in one more or less, which is about 5 days less than the current average time of 35 days to complete an application.

But most borrowers would miss the human touch when it comes to the final review of their loan application, saying they would like to speak to a human at this stage of the process in order to help them understand everything.

Carson says that Fannie Mae is partnering with lenders to digitize more aspects of the mortgage process, such as the validation of borrowers’ income, assets, and employment data. Carson notes the technology Fannie is sharing with lenders is reducing the application to delivery cycle times by 7 days. He says the goal is to reduce it by 10 days.

“Change in the mortgage industry is accelerating, opening the door for potentially significant impact and value creation for lenders and homebuyers,” Carson notes.