With home prices on the rise, a growing number of buyers are turning to unconventional types of loans to finance their purchases, especially in some western southern markets.

Unconventional financing now accounts for around 28% of the new home build market, according to a new analysis of U.S. Census Bureau data by the National Association of Home Builders. Unconventional loans including those backed by the Federal Housing Administration, VA-backed loans, cash purchases, and other kinds of financing such as Rural Housing Service loans or those offered via state and local governments.

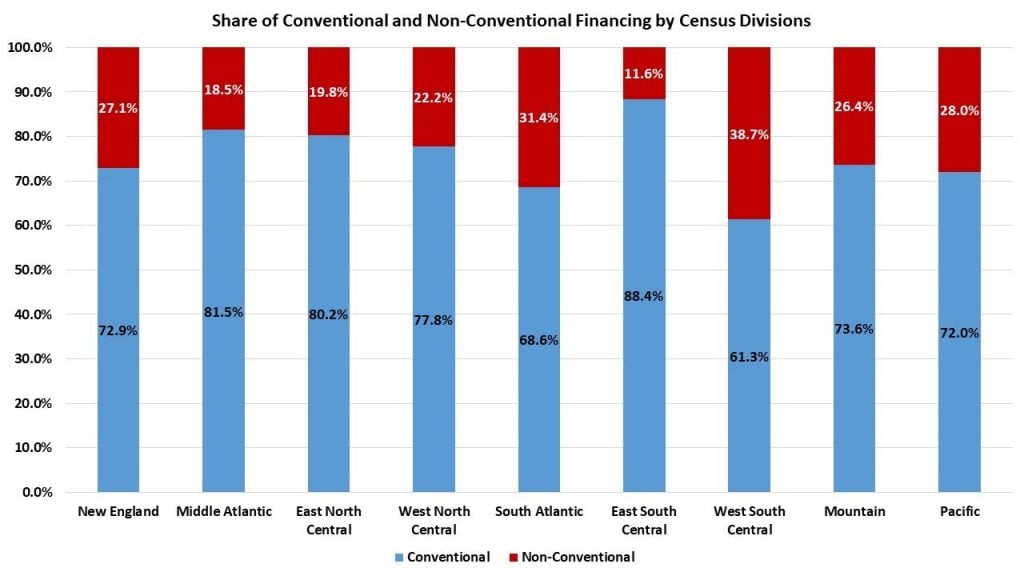

These kinds of loans are becoming increasingly popular in some parts of the nation. For instance in the West South Central region, unconventional loans account for 38.7% of all financing on homes. The South Atlantic at 31.4% is another region where unconventional loans are proving to be popular, though they’re less common in the East South Central region, accounting for just 11.6% of all loans there.

The most common type of unconventional financing is FHA loans, especially in the South Atlantic, West South Central, and Pacific regions of the U.S. Around 11% of home buyers used FHA-backed loans to buy a home in 2018, the NAHB found. Cash purchases are also quite common, accounting for 10% of all purchases.

VA-backed loans comprised 5.6% of the market nationwide. They are the most common in the Mountain division at 8.8%.

Other forms of financing, such as through the Rural Housing Service, Habitat for Humanity, and loans from state or local governments were the most common in the Pacific region of the U.S., comprising 4.6% of the market share. Nationally, these other forms of financing were used by 2.1% of buyers.