News that Compass has let go of Chief Technology Officer Joseph Sirosh did not make the company’s stock tumble. Not yet. CEO Robert Reffkin announced Sirosh’s departure at market close Thursday. The stock remained virtually unchanged ($3.25 NYSE: COMP) throughout Friday. However, it’s doubtful Reffkin, or any Compass investor slept much this weekend.

Back in June, we predicted that this market flip would put added focus on elite agents and brokers like Chicago’s Matt Laricy. The massive layoffs at Compass and Redfin earlier this year were a big warning buzzer. And now we seem to be watching as enormous investments tumble. The Real Deal story on Sirosh getting the axe doesn’t pull punches, but most of the rest of industry media uses terms like “belt-tightening” to describe what looks to me like a freefall.

In the past, Compass said that it spent $900 million to build out its technology platform. Now, the technology aspect seems questionable somehow. Compass competitors have suggested the quasi-tech firm is a residential brokerage in disguise. It looks like the detractors may have been correct, and if they were, many people invested almost a billion to build a broker recruitment hook.

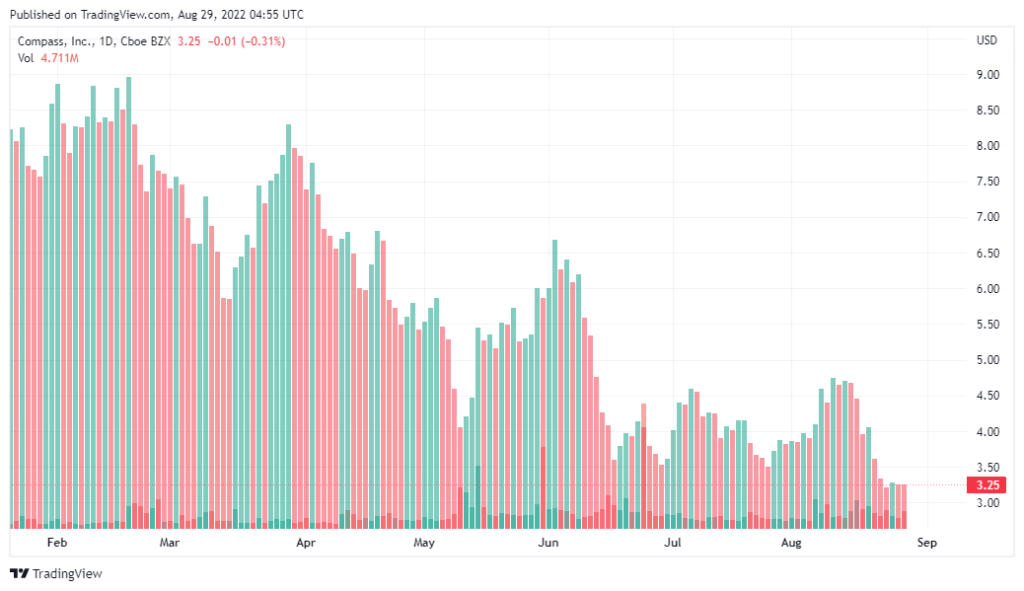

Sirosh was Compass’ CTO since late 2018 and brought viability to Compass's claims of advanced tech. He formerly worked for almost six years for Microsoft in AI and at Amazon in similar roles. This was something Compass got a lot of mileage out of before going IPO. Then, within three months of going public, the company lost 30% of its initial opening value of $20.15 on April 1, 2021. Now it’s down over 83%. It would be interesting to see who cashed out over the past year among the horde of big investors who held billions in stock early on.

In the announcement, the Compass CEO could not resist telling Inman that his company’s 28,000 agent-entrepreneurs in a statement about “enhanced tools” and the tech platform. This is sad if you think about the high hopes pinned on the idea. Not so long ago, Compass was looking like the dominant player to come. And the company had already pirated hundreds of the top agents in the U.S. When the market heated up in 2019, Compass was selling more residential real estate than anyone.

At the end of the discussion, Compass has never really turned a profit. At least not a gain you’d expect from a multi-billion dollar real estate entity with this kind of reach. And if the company cannot clean and jerk the big bucks during a housing boom, what will happen when the going gets tough? The company has also announced a $320 million “cost-reduction program,” which I am sure will thrill the remaining investors. This week should tell.

Good Morning. I’m a Compass agent operating my business in Los Angeles and have been with Compass since 2018. TheRealDeal and Inman are sponsored publications and generally dont provide quality journalism because of this. There is a lot to the story that isn’t being told and the investment community would be wise to peel back this layer to understand a bit more about the Compass Agent and the culture in the organization.

There are varying types of agents in real estate and its no secret that the most successful agents are those with several years in the business with an earned trust of clients to have repeat and referral business - not much different than the Financial Advisory business as a matter of fact. Great advisors are constantly seeking better ways to serve their customers and my 65 customers/transactions last year was earned thru the expertise I provide. For my business, I chose Compass as it currently delivers the best platform for me to communicate with my database and grow my business, which it has done significantly.. in fact, my business has nearly doubled in net income in the 4 years since agreeing to triple my brokerage overhead cost when I left ReMax.

That said, the real story investors should look for are Revenue per Agent, Agent churn, and customer sat score. I think here you’ll find a substantial difference in Compass to other brokerages and how the technology is empowering agents to be more productive and elevated services to their clients. The categorization of a brokerage is fair since its the industry we operate in however if you layer in the technology component then you’ll see something like Shopify is to small retailers, AppFolio is to Property Mangers, Mindbody is to gyms, and Salesforce is to various industries. The Compass platform is leaps above all other experiences I’ve seen and its integrated with Compass ancillary services which continue to roll out in some markets and investors will note these services operate at much higher margins than the brokerage.

Compass is a direct to agent licensed brokerage and does not have expansion limitations thru with franchised territories. Franchisees of other real estate brands struggle to profit from the brokerage operations and most brokerages in Los Angeles has escrow operations in order to make a profit. The best agents in the market recognize the franchisees limitations and continue to migrate to other brokerages. Compass Concierge (the ability to loan to home sellers 0% interest money to improve their property) continues to be a huge differentiator in our market and franchisees aren’t structured to compete with this and I think you’ll see more of this while the industry evolves more. Further, in volatile times the consumer is more inclined to rely on trusted brands and quality resources. I personally see this in my business of late and I expect the Compass market share to thrive despite the market conditions.

I mentioned culture… nothing thrills me more about Compass then the collaboration with like minded professionals nationwide. There is a lot of mud slinging in this industry however Compass agents appear to be carefully chosen and held to a higher standard - ultimately reenforcing my personal brand in my local market. Our executive suite is highly engaged in our businesses and communicate directly in agent operations so they are exposed to where the rubber meets to road and why the productivity of the technology and operations continues to impress.

I felt compelled to comment on this, thank you for the platform. I’m making my bet on Compass and I’d recommend you dig deeper than the headlines to understand the investment.

~ Tony

Thank you so much, Tony, for taking your valuable time to contribute here. I agree with most of what you say on this issue and honestly appreciate you letting our readers know the deeper experience with COMPASS. As a former public relations executive, and a media analyst for many years, I understand that nearly every digital media outlet in the world is sponsored. You mentioned my references to The Real Deal and Inman, but maybe I was not clear in my assertion that these and other outlets, sponsored by competitors or not, have really used kid gloves on this issue. Please allow me to explain the core argument in my headline and the report.

First and foremost, COMPASS is now a publicly traded company. And significant events and change have drastically affected the nature of this investment. Seconly, if I had to bet, I’d say the reason for your success has very little to do with the tools COMPASS delivers. If I were evaluating your efforts in one of our regional agent pieces, I’d put you up there with the top agents we’ve looked at. This is because you are articulate, professional, and what my Mom always called “a smart cookie.” In my lingo, you’ve optimized every tool, asset, expertise, and opportunity to serve your clients and to bring in a profit. I am sure you would do this without the Internet. I know it’s nice to have a holistic toolset. My colleagues in the tech realm have worked with most of the big ones. I’m not just buttering you up, Tony. Like other very successful entrepreneurs in this game, you’ve ticked all the boxes. But you’re not the average agent/broker, are you? This is only one point.

Here’s the thing.

Crunchbase describes COMPASS as “a real estate technology company that provides an online platform for buying, renting, and selling real estate assets.” The company has received over $1.5 billion in funding. And now, even according to you, the company is now a brokerage. This is exactly what these other media outlets have said, that ditching the tech guru who helped build the platform, plus all those other people, was a sign of something gone very wrong. Only they did not put it this way. I did. Now, since this “brokerage” community runs on capital, let’s take a quick look at these investors who should have confidence and buy.

When I wrote the first report COMPASS stock was at $3.25 per share. And this, if I remember, is an 84% dive from the initial IPO. That’s one heck of a lot of potential down the drain, and the lost opportunity costs is inestimable. It really makes no difference why. As I peck out this answer, the stock sits at $2.74, down -16.36% in five days. As my title suggests, if something does not happen pretty soon, COMPASS will end up being a penny stock. Sorry, it’s just my opinion, but…

Finally, human nature being what it is, and knowing this old Internet the way I do, I know that no key professional is going to come to ANY media outlet bringing even one paragraph about an article unless they are compelled by something a lot bigger than campfire sing-alongs at the COMPASS lake retreat. 🙂 Hate me a little, but the big dogs don’t come off the porch unless there’s a big bone in the road. That said, I’d rate COMPASS a “buy” at the current price, for sure. And that is a “compelling” note.

In all seriousness, COMPASS created a great business. And you might think my headline means I want the company to lose. This is the furthest thing from reality, Tony. I am no market expert, though I do write for Seeking Alpha. Thinking from a PR standpoint, unless these guys have some stock play going on, they should have had something big and positive to plug into the media matrix before cutting lose their CTO without really replacing him.

Anyway, I hope that savvy investors will see your comment and realize the massive potential for profit, should COMPASS edge back up to even half its IPO value. Somebody could get forever rich.

Always,

Phil

700+ transactions average PER DAY, 365 days of the year

10 new territories added in just 2 years

28,000-plus outstanding, ethical, productive agents

A spectacular array of tech tools

Over $700 million in cash and a revolver on standby.

Virtually ZERO debt.

COMPASS as a brand did not exist 8 years ago and is now internationally recognizable.

Massive fast growth + $900 million INVESTED in tech and tools + hundreds of offices opened around the USA + massive market share growth = a strong future.

Try not to listen to those with an agenda: some of the 'media' you quote are sponsored by COMPASS competitors.

Leonard, it was reported you get to keep 100% of your commissions.

Now, riddle me this?

How does a brokerage make money if it takes zero commissions from its top brokers? Does it take more from others?

Good afternoon, Mr. Steinberg. First off, thanks very much for taking the time to come and comment on this report. I know you must have read previously the many press releases and positive reports about your company since it's its inception. As one of the editors, I myself have published those releases here on RealtyBizNews. The numbers you mention are pretty well known to us, as well. You must know that the entire industry has been watching you closely, and we've been nothing short of amazed at the initial growth. That said, I don't have to be George Soros to recognize your company has a big problem. The media I quoted may or may not be sponsored by COMPASS competitors. I did not take the time to find out. The reason I cited them was to validate or illuminate what I am seeing.

I waited some time before answering because I wanted to respond appropriately. In order to do this, I wanted to collect my thoughts, and I wanted to watch the market. As I type this Compass Inc is at an all-time low of $3.02 per share just before close. I do not doubt your figures. And everyone knows how much you've invested in various acquisitions, tech, marketing, and so forth. And I am not the only one paying attention. Simply Wall Street warned 9 days ago of the bearish market on COMPASS. Two weeks ago MarketWatch sent up a red flare reporting on the short on earnings of $1.5 billion. Of course, I could go on, but the reality for most journalists and analysts is indicated by the trend.

I do not know if these financial media outlets are sponsored by COMPASS competitors, or not. I do know many on Wall Street are reporting how the recession will burst the housing bubble any day now. Just yesterday it was announced that new home listings recently fell by a record 15%. Wolf Richter says, "Housing Bubble Getting Ready to Pop – The Big Boys Leave, Waiting for Reset." And COMPASS has already been reported as bleeding cash. I know I don't need to go on.

The industry needs COMPASS, or innovative companies like it, in my opinion. You may perceive me, or others, as overly negative or even detractors. This is not actually the case. I assure you. My title was provocative, I know, but based on what I see, something needs to give, and soon. I hope that long term investors will see the relative value of COMPASS, as an opportunity for huge gains once things turn around. The figures you mention are supportive of this. It has happened many times, and I hope it happens again for COMPASS. This week.

Thank you again for taking your valuable time to comment.

Always,

Phil Butler