The NAR has just published its latest realtor's Confidence Index for March 2017. The report highlights some of the biggest roadblocks in the way of closing real estate transaction, though it also shows that Realtors are generally optimistic about real estate in general.

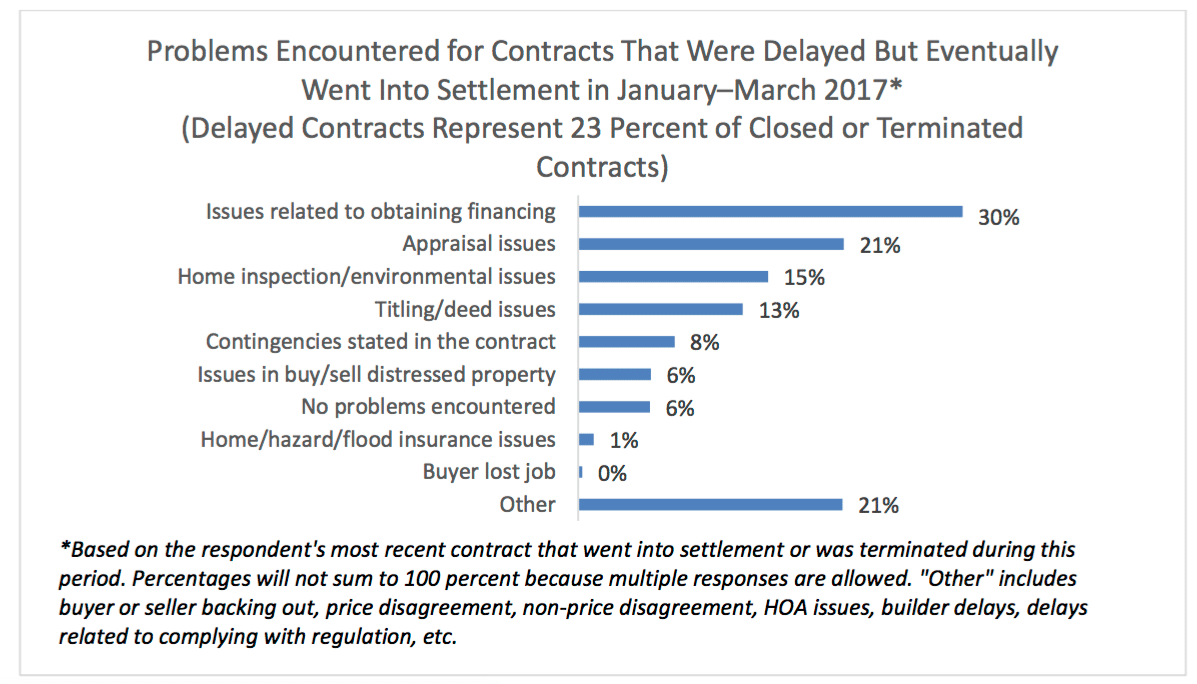

During March, 23 percent of real estate professionals surveyed by the NAR said they experienced delays in closing a transaction. Moreover, seven percent say that had at least one deal that was terminated altogether. The most common reason for delays was client's facing difficulties in obtaining finance, while appraisal issues were also cited as a common reason in the study of 2,500 realtors nationwide.

Still, even though the challenge of obtaining finance remains the biggest roadblock to closing, fewer real estate professionals are citing this as an issue today than in previous surveys. According to the report, this decline might reflect an "improvement in the economic environment, better credit histories from borrowers, and improvement in the loan evaluation processes of mortgage originations".

Instead, appraisal issues are becoming more common. Real estate professionals cite multiple problems, including a shortage of qualified appraisers, valuations that fall short of market conditions, and so-called "out of town" appraisers who're not familiar with local market conditions and may therefore make mistakes.

The problem with appraisers is becoming so pronounced that 55 percent of mortgage originators interviewed in a separate survey said they had experienced difficulty with appraisals.

Mike, I would say that the problem is not an appraisal issue but a process issue. The process of getting the appraisal assigned to a qualified appraiser through AMCs and lenders that wait until the last minute to order the appraisal.

AMCs that shop the appraisal order around to try and the cheapest appraiser so that their margins increase regardless of if the appraiser is the most qualified for the assignment.

It continues to be a false narrative that there is an appraiser shortage and that it simply not true in the majority of the nation. Appraisers are the ONLY independent part of the home buying process that is there to give an independent report on the market value of the home that the bank is lending money to purchase.

This is the same comments that were taking place prior to the last housing crash when appraisers were saying that the pressure from loan officers and agents was creating a false market that almost bankrupted our country. Allow the appraisers to be the indpendent voice and we will have a much safer housing and banking industry.

Simply on-line bank things out ... adore the pictures! I attempt to find

out by considering various other pictures, as well. http://find.hamptonroads.com/user/vb9ahm