In my previous article, I pointed out that the uptick in home sales in many areas is being driven by all cash buyers, many of whom, but not all, are real estate investors. Well, actually let me say right here that anyone smart enough to be buying in the current market at today's prices IS a real estate investor, and a darn good one at that.

Cash buyers are running the show © HitToon.com - Fotolia.com

People who bought a home when the general media said it was a good time to buy, thought that 2006 was going to be their year. Back at that time, all of the evening news shows were talking about how "hot" housing was. When the media says that buying houses is the "in" thing to do, it's usually time to stop buying and start selling.

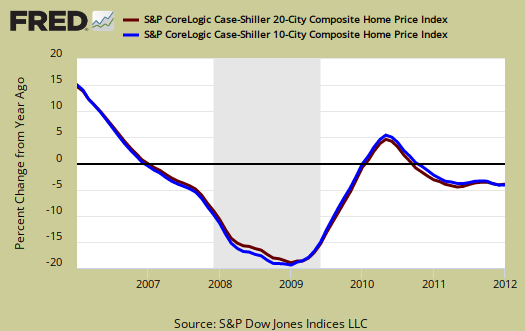

Today we have the media trying to "process" the pending homes sales data, which has ticked upward lately, along with the latest Case-Schiller 10 and 20 city composite, which shows home prices still falling in quite a few areas. Most, if not all of the pundits are scratching their collective heads, and thinking or saying that this must not be a good time to be buying a home. But alas, the cash buyers are the ones who know better. They are the ones who are smart enough to have the money to be buying when prices are at their lowest levels in years. And they are also the main reason, in my opinion, why we've seen an uptick in home sales, even as the Case-Schiller Composite shows that prices are still falling.

The most recent Case-Schiller 10 and 20 City Composite, From the St. Louis Fed.

With prices at such low levels, investors buying with all cash certainly realize that there are cash flow opportunities to be had. So you have many of the smart investors moving back into the market in a big way , for the first time since before housing prices peaked in 2006. And foreign buyers have more cash as well. They are also making it known that they are looking to buy. This is likely the primary reason for the increase in pending sales numbers to a significant degree.

Investors know that today's low prices mean it's the first real opportunity in years for strong positive cash flow on rentals. And those investors who buy foreclosures, fix them up, and then resell them to an owner occupant are seeing some of their best cash profits in years. For them it's not a question of wondering which way prices are going, it's a matter of cash flow. And in this market, with the low prices, the investors are finally making some good money again. Also a plus, those owner occupant buyers are getting some very nice homes for about 25% below those peak market prices

This is resulting in the paradox of increasing pending sales numbers, without a corresponding increase in home prices. Cash buyers, and investors in particular, have no intention of doing anything to drive home prices up with regard to the buy side. If anything, their ability to buy with cash is making it possible for them to get better bargains, and in so doing, it's tending to force prices down further in the areas with the most foreclosure inventory.

But those same investors are very important to the long term future of the housing market, because they will take those homes that the owner occupant buyers would not want, and put them back into service as affordable rental property, or fix the better ones and give an owner occupant buyer a great deal on a newly renovated home.

With foreclosures still running at record levels, and many more in the pipeline, many areas will continue to see the paradox of an increase in sales numbers with little or no increase in home values until all of the excess inventory has been exhausted. For now, it's the best of times for smart real estate investors and home buyers, in spite of the fact that the general media is reporting otherwise.

---------------------------------------------------------------------------------------------------------------

Donna S. Robinson is a 16 year veteran of the real estate industry, and a staff writer for Realty Biz News. She is a real estate investor, author, investing consultant and housing market analyst. Her website www.RealtyBizConsulting.com offers a variety of opportunities for real estate investors. Contact Donna at 888-915-9968 for consulting services.