Property listings website Trulia has published the findings of its latest Inventory and Price Watch index. The company's quarterly look at the supply of starter, trade-up and premium homes on the market nationally and in the 100 largest U.S. metros found that falling inventory is strongly correlated with how long homes stay on the market.

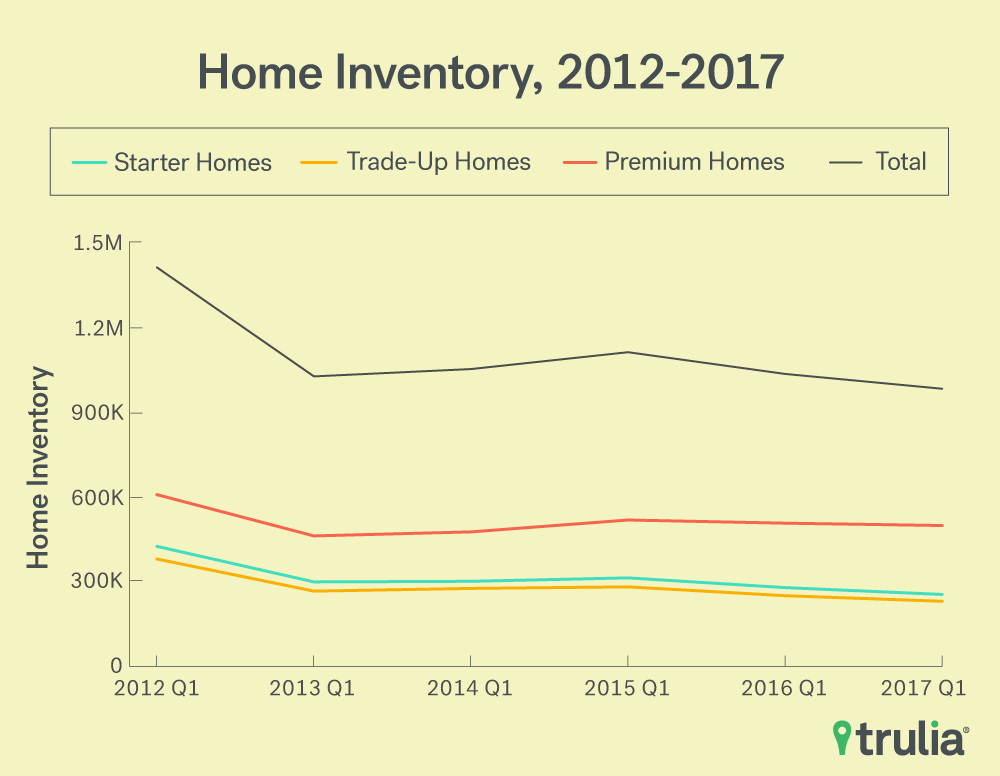

Between April and June, U.S. home inventory tumbled 8.9% nationally year-over-year, and has now fallen for a record nine consecutive quarters. Inventory today is 20% lower than it was five years ago with the current number of starter and trade-up homes on the market decreasing 15.6% and 13.1% respectively, during the past year. Meanwhile inventory of premium homes has fallen by just 3.9%.

Falling inventory has also pushed affordability of homes across all segments to new post-recession lows. A typical starter-homebuyer would need to dedicate 39.1% of their monthly income to buy a starter home – a 3.1-point increase from last year – while trade-up homebuyers need 26.0% more than this time last year. Premium homebuyers fared the best as they need to shell out 14.3% more of their income.

Across metros, falling inventory strongly correlates with how long homes stay on the market. On average, the more a market's housing inventory has fallen over the past five years the faster homes come off the market. In 2012, 57% of homes nationally were still on the market after two months, while today that number has fallen to 47%.

Housing markets with the largest decreases in inventory during this time have also seen significantly fewer homes for sale after two months. Hurried homebuyers this spring can mostly be found in the West, except for Columbus, Ohio, while the slowest moving markets are predominately in the South and Northeast.

"As inventory continues shrink, the few homes that are available are flying off the market within a couple of months," said Trulia's chief economist Ralph McLaughlin. "In the tightest markets in California, only 1 in 4 homes are still on the market after two months. Clearly, this spring is not bringing the inventory relief buyers so desperately need. In today's frenzied market, buyers must be prepared to (1) move fast, (2) be flexible with sellers' timelines, and (3) make multiple offers."