More than 90 percent of seniors would like to age at home, according to research from the American Association of Retired Persons. Many envisage staying in their current homes where most have happy memories, while some want to downsize. The option is there, but at the same time it’s necessary to understand what’s feasible and what isn’t.

Seniors need to consider if their retirement investments will go the distance, and if not, they need other options in place.

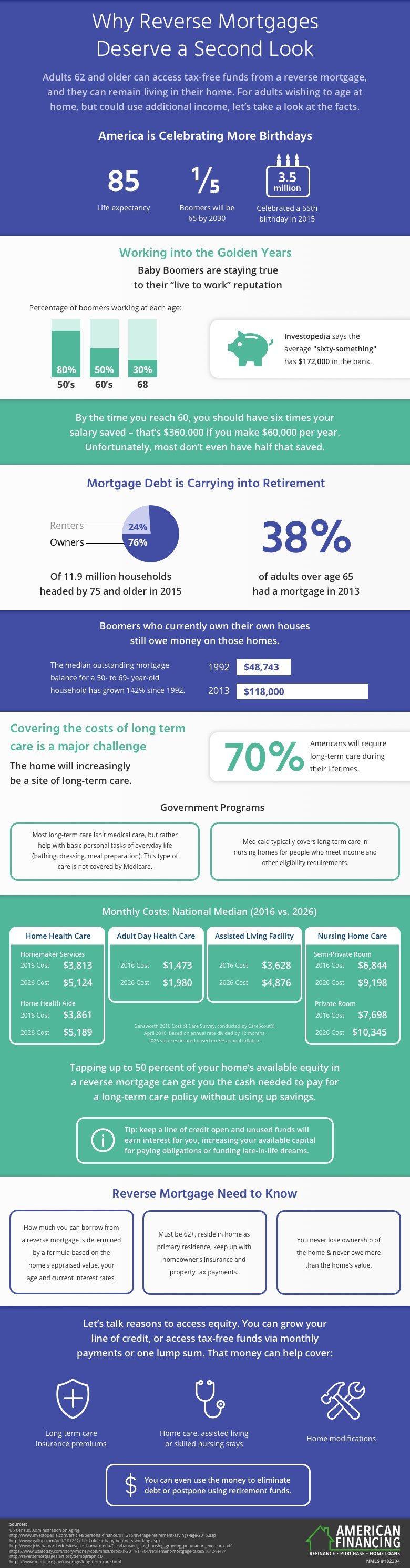

One such option is called a reverse mortgage, a type of home loan for older homeowners that requires no monthly mortgage payments. With a reverse mortgage, elders can access the equity they have built up in their homes, defering payment of the loan until they die, sell, or move out of the home.

The reverse mortgage deserves closer scrutiny. It’s usefulness for seniors has improved recently due to mandatory education, tighter eligibility requirements and new legislation that prioritizes applicant’s right to stay in their home, even when they’ve exhausted their available equity.

“Using a reverse mortgage to pay for long-term health care—such as a long-term care insurance premiums, payments to caregivers or nursing homes, and modifications to make a home more accessible—can be a wise financial move for seniors,” said Laura Adams, insurance expert with InsuranceQuotes.com. “Taking a reverse line of credit, through the Home Equity Conversion Mortgage (HECM) program, allows qualified homeowners over the age of 62 to tap some amount of their home equity and spend it any time and for any reason. Interest is charged on withdrawals, but unused funds can accumulate interest over time.”

Adams provides an example of a married 62-year old in Colorado, owing $15,000 on a home valued at $160,000. The 62-year old plans to live in his home until he dies, so he signs up for a long-term care policy paying $150 in daily benefits for up to four years. The expected premium comes to $4,082.04 per year. As such, tapping into his home equity would allow him to make 32 years of payments at $3,942 per year, ensuring he can access long-term care without touching his retirement savings.

Reverse mortgages can be a viable way to free up equity. When we looked into this for my parents, the fees were so high they opted against. One of the things putting pressure on their finances was their long term care insurance premiums. Luckily, the LTC premiums have been waived on my father's policy since he is now on claim. LTC Insurance