Zillow is putting a hold on its iBuying operations until the end of the year after reaching “operational capacity” according to a statement by the company.

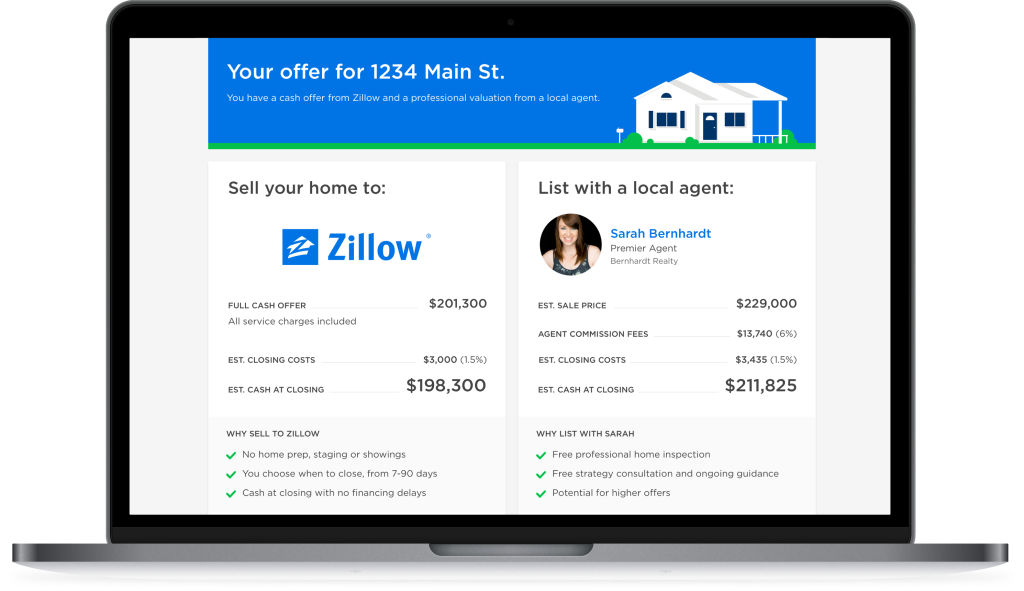

The pause comes three years after Zillow gatecrashed the iBuying market with its Zillow Offers service, which allows homeowners to obtain an instant cash offer on their property and then sell it instantly, if they’re interested in a quick sale.

Zillow Offers uses algorithms to determine the value of the offers it makes on people’s homes. For each property it buys, it then makes some renovations before putting it back on the market and trying to sell at a profit.

The company says the pause announced Monday is temporary and that it will continue to renovate and attempt to resell its existing inventory of homes.

Zillow Chief Operating Officer Jeremy Wacksman said the company is operating within a “labor and supply constrained economy” amid a highly competitive real estate market. He said the shortage of labor is especially acute within the construction, renovation and closing industries.

“We have not been exempted from these market and capacity issues and we now have an operational backlog for renovations and closings,” Wacksman added. “Pausing new contracts will enable us to focus on sellers already under contract with us and our current home inventory.”

While Zillow didn’t elaborate on the labor and supply issues, it’s notable that Zillow Offers is far from being a fully automated business despite its use of AI algorithms. Before buying any home, Zillow sends a human inspector to check each property to ensure it has no fundamental issues. Then, once it purchases a home, it will send in contractors to carry out minor refurbishments.

But the coronavirus pandemic has stretched the labor market across dozens of industries, and now, finding labor to perform those tasks is a challenge. Jobs in the construction industry were down by more than 200,000 last month compared to February 2020. Supplies are an issue too, with shortages of lumber and other building materials adding to the difficulty. Those problems have been exacerbated by Zillow’s decision to allow homeowners to set a closing date months ahead of time, which meant it could buy a property in March, for example, and only begin renovations in November when the deal closes.

Zillow isn’t the only company to have its operations constrained – last month, Lennar told investors on an earnings call that it’s unable to ramp up construction to meet demand due to labor and supply problems.

The decision to halt Zillow Offers is still a surprise though, as the company had never alluded to the labor and supply issues before. On the contrary, in its second quarter earnings report in August it told analysts it expects to accelerate its home purchases through Zillow Offers.

Incidentally, this is not the first time Zillow has paused Instant Offers. Back in March 2020 as the coronavirus pandemic began taking hold across the globe, Zillow and most of its competitors in the iBuying space all suspended their buying activity amid the general uncertainty. The industry resumed its activity a few months later, but the major players have struggled to make a profit since then.

One of the problems with the iBuying model is that in a seller’s market such as today’s, there’s less incentive for homeowners to opt for a quick sale at a reduced price. With housing inventory so low, most can list their home and receive an offer in just a few weeks, or very often even days. Bidding wars are common too, and many might feel they have a good chance of receiving an offer that goes above and beyond their home’s listed value.

Those market conditions have battered the iBuying industry, with Zillow and its main rival in the space, Opendoor, losing a combined $607 million from their operations in 2020.

Investors took news of the pause seriously, with Zillow’s stock falling 11.4% in trading yesterday, its biggest intraday slide in seven months.

On the other hand, the announcement was good news for Opendoor, which gained 7.9% in the wake of the news. The company was quick to reassure investors and consumers alike it has no intention of pausing its own buying activity.

“We know how important certainty and convenience are to homeowners seeking t move and we’ve worked hard over the past seven years to ensure we can continue to deliver our experience at scale,” the company said in a statement. “Opendoor is open for business and continues to scale and grow.”

Another rival, Offerpad, said Monday it is actually planning to expand its business into new markets, including Sacramento, San Bernardino and Riverside in California.

“Offerpad’s ibuyer operations are running as smoothly as ever,” a spokesperson for the firm told media.

During its August earnings call, Zillow said it acquired 3,805 homes during the second quarter and possessed $1.2 billion worth of unsold homes. The ibuying business generated $772 million in revenue during the period from the sale of 2,086 homes, though it still posted a net loss before taxes and other costs.

Still, Zillow itself remains profitable. The company reported a net profit of $9.6 million in Q2 due to the profitability of its Premier Agent program, where agents pay a monthly fee to advertise themselves as buyer’s agents on its listings website.

Until it resumes ibuying activity, the company plans to refer any Zillow Offers customers to its traditional real estate agents. “For prospective sellers, Zillow Offers is connecting them with a local premier agent partner,” Zillow said.

Amazing. This is really great post about the real estate. Some people say "Landlords grow rich in their sleep."