Buying a home is one of the most exciting things you will ever do. It is also likely the most expensive thing you will ever do. Odds are you will not be able to buy your home upfront and will need a home loan.

New 15-Year ‘Wealth-Building’ Mortgage for Low-Income Buyers?

Two mortgage executives are hoping to overhaul the 15-year mortgage, making it more readily available to low and moderate-income people. They say the changes will help borrowers build equity at a much faster pace than they would with a standard loan.

Understanding The Real Costs Of Government-Insured Home Mortgages

There’s no shortage of options when it comes to financing your next personal home purchase. The list of potential options includes FHA, VA, USDA, and a myriad of other “low-down-payment” loans available. This category of loans is known as “government insured,” meaning that the lender can file an insurance claim through the appropriate government agency, (FHA, VA, etc), if the borrower defaults on the mortgage.

4 Ideas For Saving Thousands Of Dollars On Your Mortgage Payment

If you are a typical home buyer, paying less than 20% down, there is about a 90% chance that you’ll use an FHA, VA or USDA loan to finance the purchase of your first home. If you do choose one of these “government insured” loans, you’ll be subject to high fees and interest costs that will amount to more than the entire price of your home.

House For Sale: What Does It Take To Buy A Home?

When a home buyer sets out to purchase their first home they quickly discover that there are a lot of details involved. To make matters worse, the details vary depending on each individual buyers situation. While the general process is the same for each transaction, the details are likely to be somewhat different in each case.

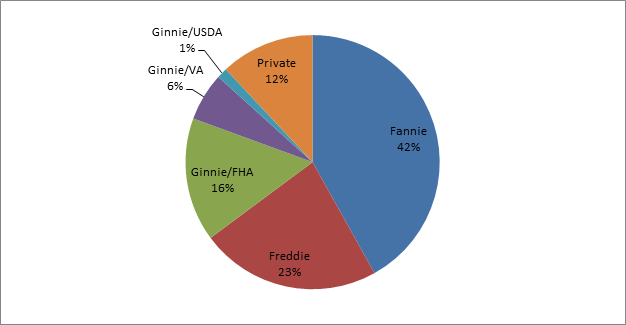

Government Takeover Of The U.S. Mortgage Industry Is Almost Complete

Since the housing melt-down in 2008, Government domination of the U.S. mortgage market has grown exponentially. Virtually all private investment capital has disappeared from the mortgage industry, meaning that anyone who depends on home sales for a living is facing the prospect of their economic future being controlled by a small group of government institutions

Is Uncle Sam Helping The Housing Market, Or Merely Finishing It Off?

According to the May 2012 Issue of FHA Watch, Uncle Sam is now a totally dominant force in home mortgage financing, along with other major sectors of the U.S. economy. But the question is, is this a help or a hindrance?

Residential Real Estate Industry Cringes As Dodd-Frank Era Begins

The financial regulatory bill known as Dodd-Frank, named for it’s two main congressional proponents, Chris Dodd and Barney Frank, has begun to kick in. The bill is more than 1,000 pages in length, and will address virtually every corner of the residential real estate industry. Virtually no one in the industry will avoid the impact